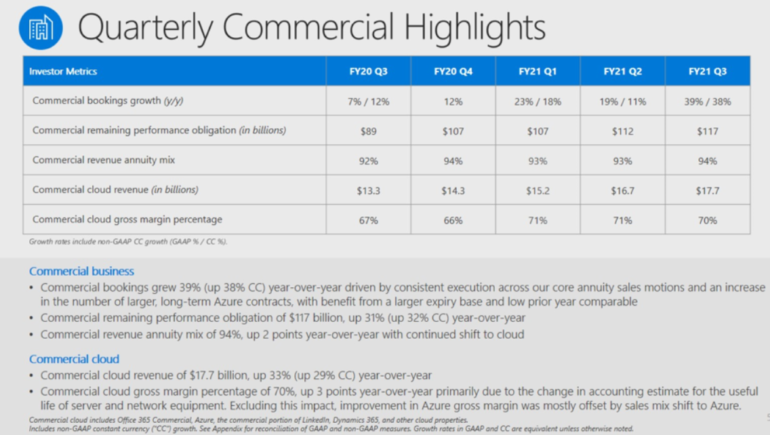

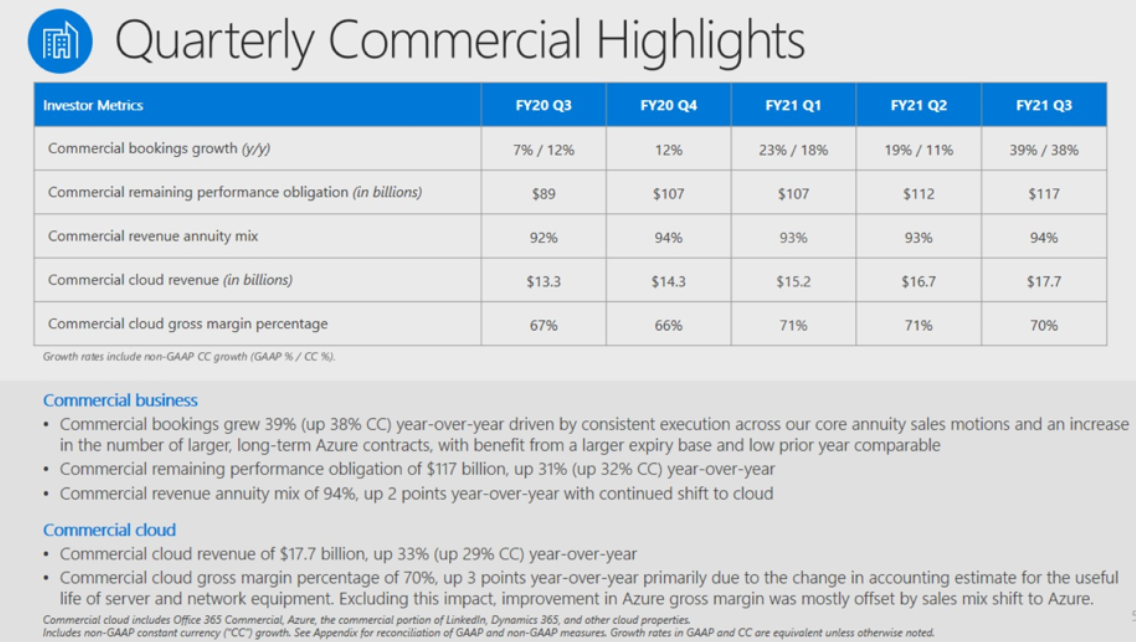

Microsoft’s fiscal third quarter results were well ahead of expectations as the company’s commercial cloud revenue checked in at $17.7 billion, up 33% from a year ago. Azure revenue growth was 50%.

The company reported third quarter earnings of $15.5 billion, or $2.03 a share, on revenue of $41.7 billion, up 19% from a year ago. Non-GAAP earnings for the quarter checked in at $1.95 a share.

Wall Street was expecting Microsoft to report third quarter revenue of $41.03 billion with non-GAAP earnings of $1.78 a share.

CEO Satya Nadella said “digital adoption curves aren’t slowing down. They’re accelerating.”

What you need to know:

Indeed, Microsoft’s commercial cloud bookings growth appears to be accelerating year over year.

Microsoft’s portfolio is benefiting from a broad digital transformation push for corporations.

Among the key items:

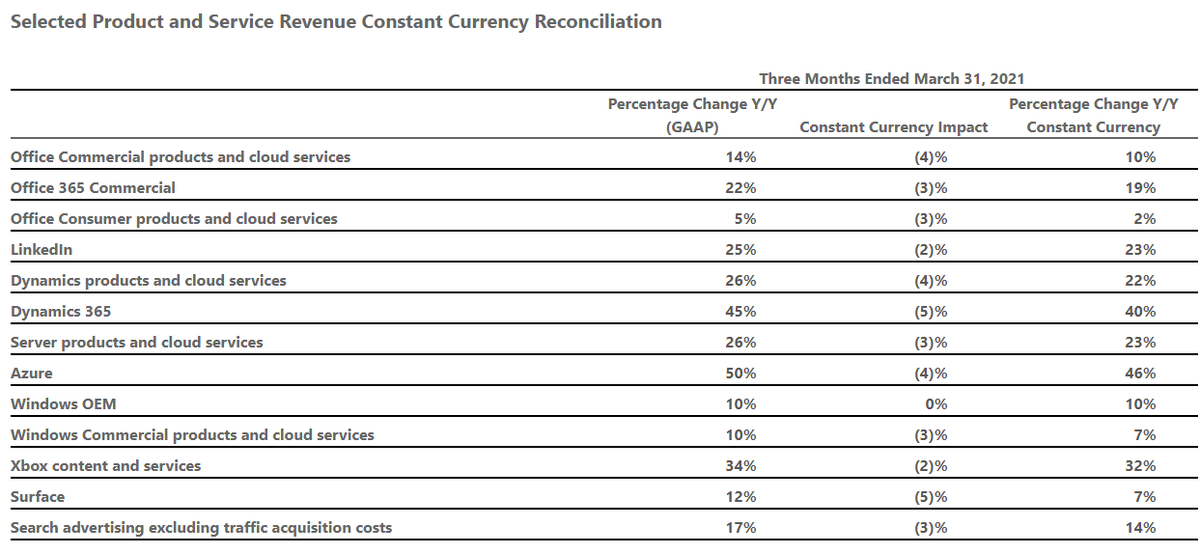

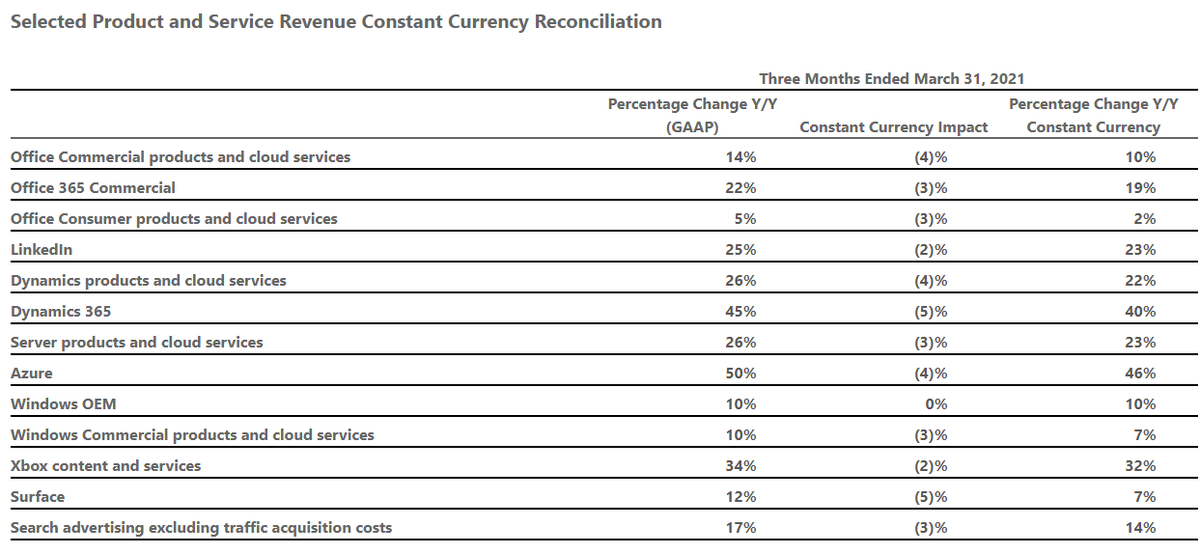

Revenue in the productivity and business processes unit was $13.6 billion, up 155 from a year ago. Office products and cloud services revenue was up 14%.Office Consumer products and cloud services revenue was up 5%. That growth rate was among the slowest in the company. Microsoft 365 Consumer subscribers checked in at 50.2 million.LinkedIn revenue was up 25% and Dynamics product and cloud services revenue was up 26%. Intelligent Cloud revenue was $15.1 billion with gains in Azure revenue, which was up 50%. Azure revenue growth was in line with the fiscal second quarter pace.

More Personal Computing revenue was $13 billion, up 19% from a year ago. Surface revenue was up 12% with Xbox content and services revenue up 34%. Surface revenue was $1.5 billion, up from $1.34 billion a year ago and down from $2.04 billion in the fiscal second quarter. The best Surface? See which Microsoft Surface PC is right for you

Add it up and Microsoft delivered a strong quarter, but it’s clear that consumer Office sales are lagging. Microsoft is prepping plans to appeal to more prosumers and consumers. Where’s Microsoft going next in the ‘prosumer’ space?