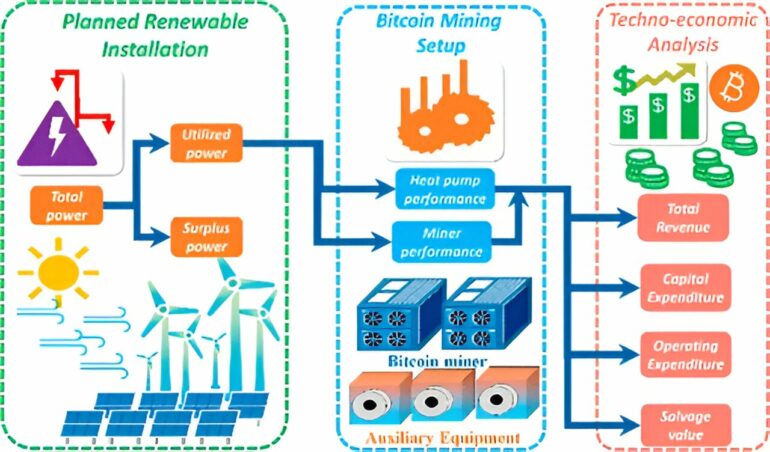

Bitcoin mining is often perceived as environmentally damaging because it uses huge amounts of electricity to power its intensive computing needs, but a new study demonstrates how wind and solar projects can profit from bitcoin mining during the pre-commercial development phase—when a wind or solar farm is generating electricity, but has not yet been integrated into the grid.

The findings suggest some developers could recoup millions of dollars to potentially invest in future renewable energy projects.

The study, “From Mining to Mitigation: How Bitcoin Can Support Renewable Energy Development and Climate Action,” was published in the journal ACS Sustainable Chemistry & Engineering and is authored by Cornell University doctoral student Apoorv Lal and Fengqi You, professor in energy systems engineering at Cornell. Jesse Zhu, professor from the Western University of Canada, also contributed to the research.

Texas emerged from the analysis as the state with the most potential, with 32 planned renewable projects that could generate combined profits of $47 million using bitcoin mining during precommercial operations. Projects in California produced the second highest profits in the study, while Colorado, Illinois, Iowa, Nevada and Virginia had fewer installations but still show profitability.

“Profitability of a mining system hinges on periods of steady energy availability since renewable energy sources can vary significantly,” said You. “Therefore, it is important to site the mining farm strategically to maximize productivity.”

As an example, You pointed to California, Colorado, Nevada and Virginia as states where solar installations were the only type of renewable energy project that proved profitable in generating bitcoin during the precommercial phase.

The researchers suggest several policy recommendations that could help improve the economic feasibility of renewable energy projects and reduce carbon emissions. One is to provide economic rewards for environmentally responsible cryptocurrency mining, such as carbon credits for avoided emissions.

“These rewards can act as an incentive for miners to adopt clean energy sources, which can lead to combined positive effects on climate change mitigation, improved renewable power capacity, and additional profits during precommercial operation of wind or solar farms,” Lal said. “We also recommend policies that encourage cryptocurrency-mining operations to return some of their profits back into infrastructure development. This would help create a self-sustaining cycle for renewable energy expansion.”

While the study’s authors acknowledge other aspects of cryptocurrency mining still have environmental costs, for example, metal depletion and hardware that becomes obsolete within a few years, they said the results indicate that there are ways to mitigate some of the environmental costs of cryptocurrency mining and foster investments in renewable energy.

More information:

Apoorv Lal et al, From Mining to Mitigation: How Bitcoin Can Support Renewable Energy Development and Climate Action, ACS Sustainable Chemistry & Engineering (2023). DOI: 10.1021/acssuschemeng.3c05445

Provided by

Cornell University

Citation:

Study shows how wind and solar projects could profit from bitcoin mining (2023, November 27)