It is widely recognized that finance is one of the critical enablers of accelerating climate action. However, renewable energy deployment (particularly in developing countries) requires more financing than fossil fuel-based alternatives due to a combination of factors, such as higher upfront investment costs.

This means that finance itself can become a barrier to mitigation investment, which is particularly problematic in the context of energy justice—making renewable energy more widely accessible in low-income countries and communities.

A new international research effort led by CMCC scientists tackles this issue by investigating how financial policies help ensure a just transition through a reduction in the cost of capital for energy technologies in the Global South.

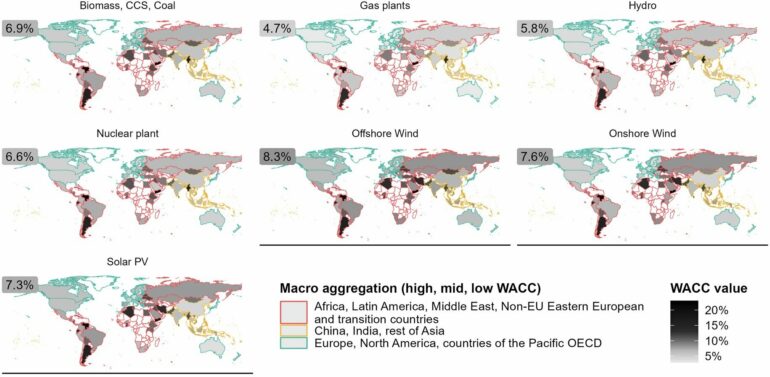

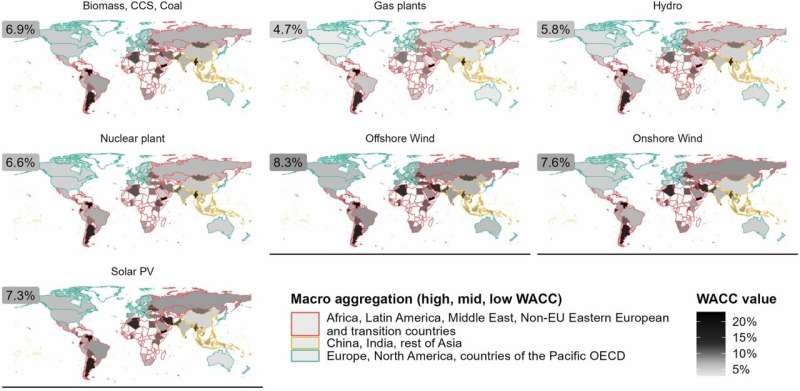

The paper, published in Nature Energy, quantifies the importance of financing cost on the equity and efficiency of the energy transition, empirically estimating the cost of capital for a range of technologies in different countries and then including them in five coupled energy-climate-economy models. This reference scenario is then compared to a fair-finance policy in which risk premia around the world reach those of mature economies by 2050.

“In the fair-finance policy scenario, the quantity of renewable electricity generated in developing countries increases, leading to 30% of the renewable electricity needed in the Global South to keep global warming under 1.5°C and 10% of the fossil fuel reduction,” says Matteo Clacaterra, lead author of the study.

Empirically calibrated WACC values by technology and country. © Nature Energy (2024). DOI: 10.1038/s41560-024-01606-7

Furthermore, although the paper does show that the effects on mitigation in developing countries depend on the emissions scenario chosen—the higher the ambition, the cheaper the cost of mitigation, and the lower the ambition, the higher the carbon intensity reduction—it also reveals how, on aggregate, developing countries reduce their energy expenditure to GDP ratio by up to 5%.

“All this increases global equity of the clean energy transition: inequality is reduced in per-capita renewable energy generation by 2-4%, and electricity also becomes cheaper by an average of 10% after mid-century,” continues Calcaterra, demonstrating how international convergence in the cost of capital for energy financing enables the greening of the energy system while at the same time increasing the justice of the transition.

These conclusions have important implications for policy choices, as they reveal that equalizing the cost of capital of the energy sector internationally can play a significant role in greening electricity generation, lowering the cost of mitigation and improving equity. However, what form those policies should take remains a critical avenue for future research.

“This research was necessary to further highlight the impact of financing costs on renewable energy development,” says Massimo Tavoni, director of the European Institute on Economics and the Environment at CMCC and co-author of the study.

“We showed that fair financing is a key enabler of energy availability, affordability and equity at a global level. We hope that this research will help promote a fair and effective climate transition.”

More information:

M. Calcaterra et al, Reducing the cost of capital to finance the energy transition in developing countries, Nature Energy (2024). DOI: 10.1038/s41560-024-01606-7

Provided by

CMCC Foundation – Euro-Mediterranean Center on Climate Change

Citation:

Clean energy transition: The impact of financial costs on the development of renewable energy sources (2024, September 27)