IBM reported better-than-expected first quarter earnings and showed revenue growth after posting declines throughout 2020.

The company reported first quarter sales of $17.7 billion, up 1% from a year ago. Earnings were $1.06 a share and non-GAAP earnings per share were $1.77.

Wall Street was expecting IBM to deliver first quarter revenue of $17.34 billion with non-GAAP earnings of $1.63 a share.

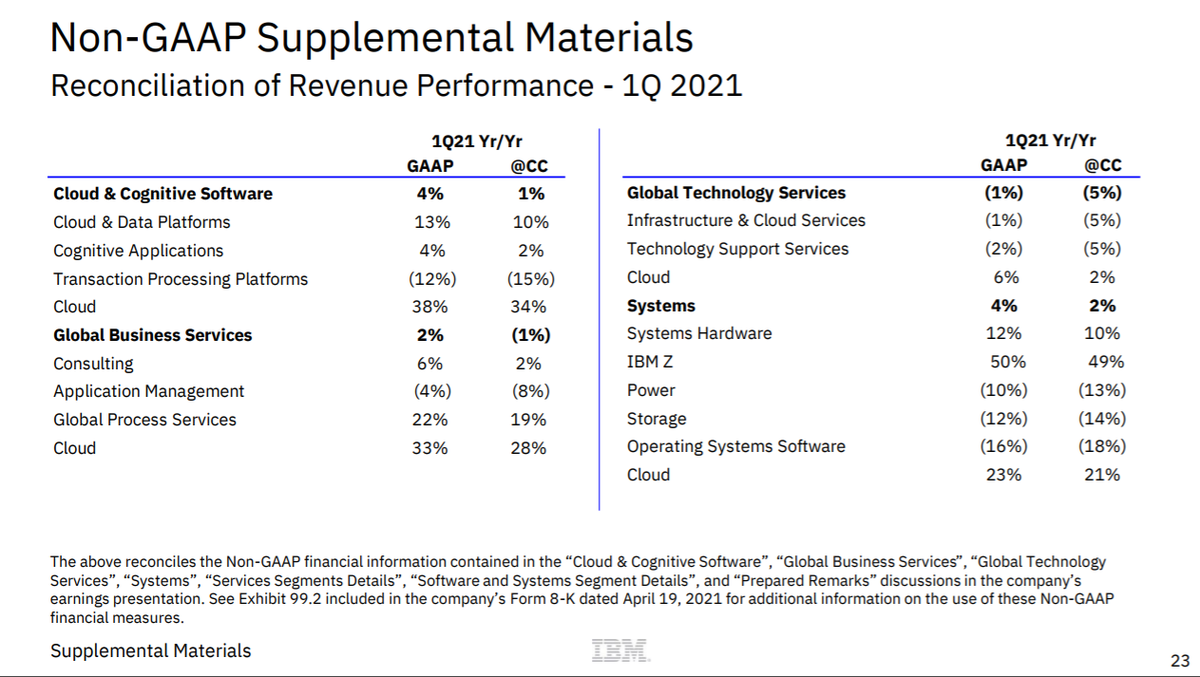

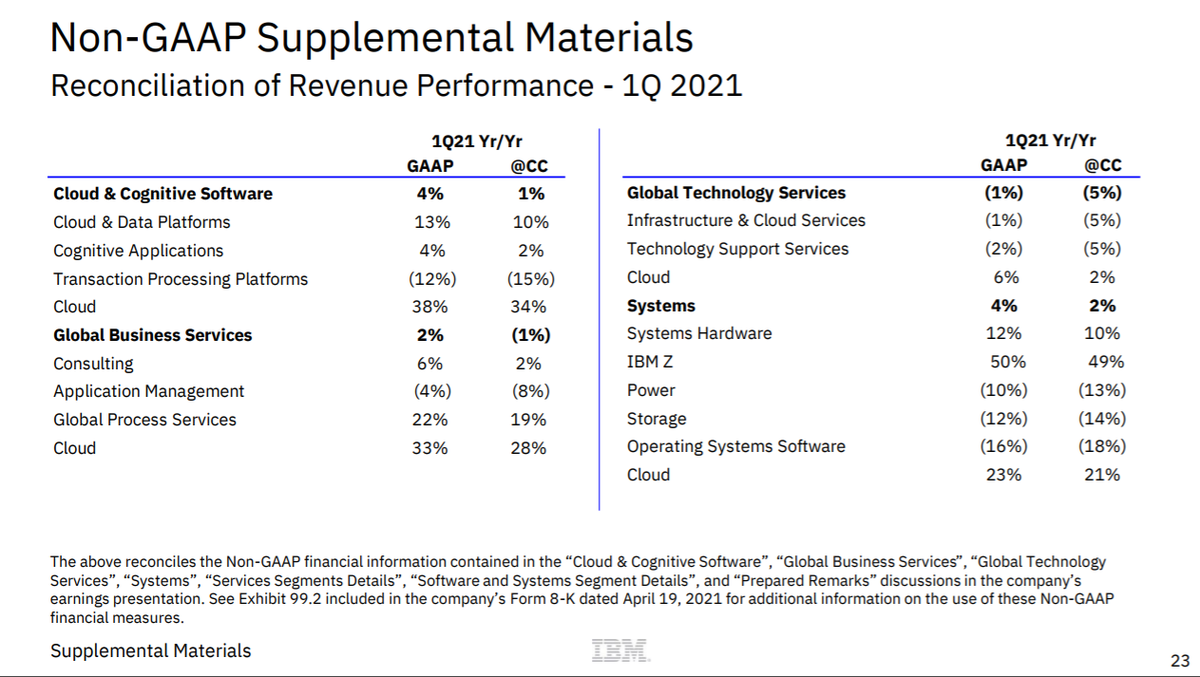

IBM said Red Hat revenue was up 17% from a year ago and cloud and cognitive software sales grew 4%. Systems revenue was up 4%.

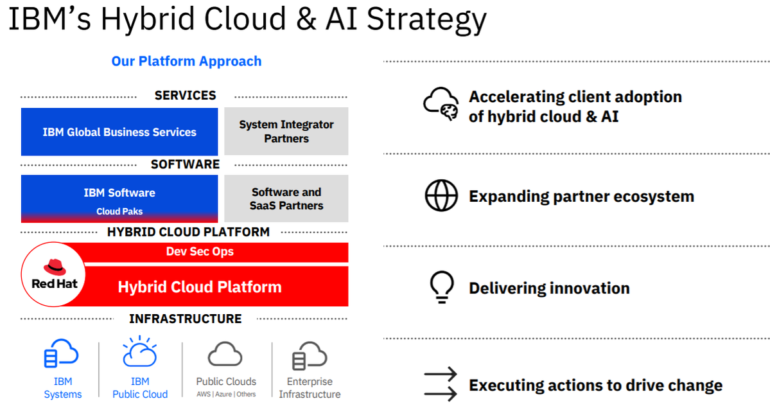

IBM’s first quarter featured a series of moves as the company positions for the future as it built out its quantum computing, named its managing services spin-off Kyndryl and targeted industry-specific cloud offerings.

As for the outlook, IBM is projecting 2021 revenue growth, adjusted free cash flow of $11 billion to $12 billion excluding charges to spin off its managed infrastructure services business.

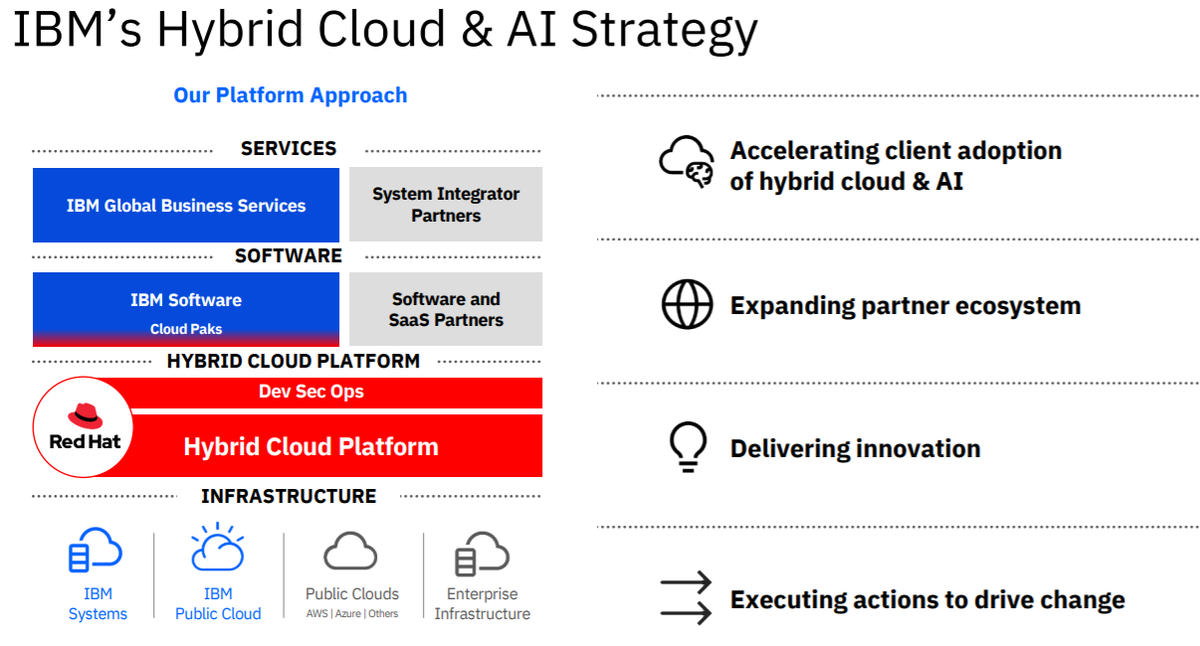

CEO Arvind Krishna said IBM was seeing increasing adoption of its hybrid cloud platform. “While we have more work to do, we are confident we can achieve full-year revenue growth and meet our adjusted free cash flow target in 2021,” he said.

Krishna said the IT spending environment is improving. He said:

I think that the spend environment overall is improving. I do have to acknowledge there are some differences by geography and industry. When you look in the underlying results, you can see the Americas were stronger. There are pockets in Asia that depends very much by country, and we can all guess which ones are doing better, which ones are doing worse. It does depend upon both COVID rates and the pauses that happened due to business circumstances. We do sense a bit of caution in Europe, and you can see that in the numbers. You can also see that there are going to be differences by industry.

We do see our clients accelerate their digital transformation. And as they accelerate their digital transformation, our hybrid cloud thesis comes to play very strongly.

CFO James Kavanaugh said on the earnings conference call:

With about 3,000 hybrid cloud platform clients, we’ve now tripled the revenue base of OpenShift since we acquired Red Hat.

Kavanaugh also cited IBM’s hardware strength in mainframes.

Our IBM Z revenue was up 49%. That’s very strong growth, especially more than 6 quarters into the z15 product cycle. We had traction in areas like financial services, where robust market volatility drove demand for increased capacity. IBM Z is an enduring platform, developed and optimized to support enterprise’s most mission-critical applications.

Key items include:

The cloud and cognitive software unit had revenue of $5.4 billion with cloud and data platforms seeing growth of 13%. IBM said adoption of its Cloud Pak lineup boosted growth. Cognitive applications were led by security applications. Transaction processing platform revenue fell 12% and cloud revenue was up 38% in the first quarter. IBM said it had 3,000 hybrid cloud platform clients. Global business services revenue was $4.2 billion, up 2.4%. IBM saw growth in consulting and global process services and declines in application management sales. Global technology services revenue was $6.4 billion. Systems revenue was $1.4 billion led by IBM Z. IBM said Power and storage systems saw sales declines.