Renewable energy generation technologies such as solar, wind, and hydro continue to gain popularity worldwide. As more and more renewable generation enters the grid, the success of these clean technologies will increasingly rely on the development of long-duration energy storage solutions that support variability in electric power generation.

Researchers at the National Renewable Energy Laboratory (NREL) have developed a rigorous new Storage Financial Analysis Scenario Tool (StoreFAST) model to evaluate the levelized cost of energy (LCOE), also known as the levelized cost of storage (LCOS). This model can identify potential long-duration storage opportunities in the framework of a future electric grid with 85 percent renewables penetration. Researchers designed StoreFAST based on the successful Hydrogen Financial Analysis Scenario Tool (H2FAST), which was created by NREL in 2015 as a convenient aid for analyzing the financial aspects of installing hydrogen fueling stations.

“The H2FAST model is very flexible,” said Michael Penev, an infrastructure systems analyst at NREL. “There is nothing inherently specific to its use for hydrogen. For example, we have used this framework for analyzing cost of long-haul trucking, ammonia production, electric vehicle charging, and more. StoreFAST targets this analysis toward energy storage to calculate the efficiency of different systems.”

StoreFAST is a unique techno-economic tool in that it analyzes both energy storage systems and flexible power generation systems on a side-by-side basis. The model outputs visuals for three parameters: the LCOE, financial performance parameters, and time series charts for all financial line items. Primary inputs to the model include system power output capacity, capital costs, operations and maintenance (O&M) costs, charging electricity or fuel costs, storage duration, and capacity factors.

StoreFAST offers a consistent comparison across all technologies by analyzing key parameters describing system cost, performance, and capacity factor to calculate the net present value of all capital, operating, tax, and financing expenses divided by the system lifetime electricity sales. This definition of LCOE offers a consistent comparison of storage technologies.

StoreFAST in action

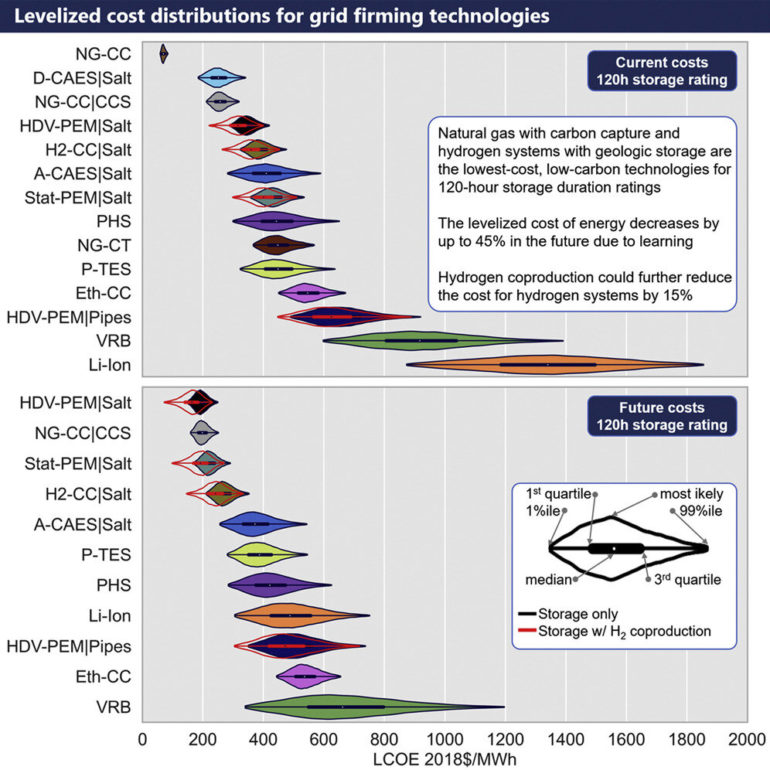

A recent Joule article provides a detailed techno-economic evaluation of various storage technologies. Penev presented the findings of that study, alongside a StoreFAST demonstration, during the Department of Energy’s (DOE’s) Hydrogen and Fuel Cell Technologies Office’s March H2IQ Hour. Researchers at NREL used the StoreFAST model to analyze the system from 12 hours up to seven days of storage duration. Duration rating of storage is defined as how long it would take each system to completely discharge energy while providing full-rated power to the grid.

“Our techno-economics analysis team performed a rigorous literature review and gathered industry and DOE input on today’s cost characteristics and the future cost reduction potential for eight different long-duration energy storage systems,” Penev explained. “Those characteristics are condensed in the model and are conveniently available for analysts to benchmark with any other energy storage technologies of interest.”

The study found that for long durations of energy storage (e.g., more than 60 hours), clean hydrogen systems with geologic storage and natural gas with carbon capture and sequestration are the lowest cost options, regardless of whether system costs are based on current or future technology. Researchers also modeled the cost of an innovative energy storage system using fuel cells designed for heavy-duty vehicles rather than conventional stationary fuel cells, and found that this system achieved 13 percent–20 percent lower LCOE.

Funding for this work was provided by the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Strategic Analysis Team, Hydrogen and Fuel Cell Technologies Office, Solar Energy Technologies Office, and Wind Energy Technologies Office. In addition to Penev, key contributors within NREL included Chad Hunter, Evan Reznicek, and Joshua Eichman.

Improving financial analysis at NREL

In addition to StoreFAST and H2FAST, NREL also offers an Electric Vehicle Infrastructure—Financial Analysis Scenario Tool (EVI-FAST) that leverages the same framework to model side-by-side scenarios of electric vehicle charging equipment. A recent Joule article reviews analysis from EVI-FAST to determine the LCOE of charging electric vehicles in the United States.

The NREL team is identifying new ways to specialize the FAST models for future analyses, including integrating the formula into Python to allow researchers to look into capacity expansion and refurbishments. Future versions of the models will be able to evaluate the degradation of different systems over time, as well as include statistics on impact analysis.

Researchers take a practical look beyond short-term energy storage

More information:

Chad A. Hunter et al, Techno-economic analysis of long-duration energy storage and flexible power generation technologies to support high-variable renewable energy grids, Joule (2021). DOI: 10.1016/j.joule.2021.06.018

Provided by

National Renewable Energy Laboratory

Citation:

New financial analysis tool for long-duration energy storage in deeply decarbonized grids (2021, July 30)

retrieved 31 July 2021

from https://techxplore.com/news/2021-07-financial-analysis-tool-long-duration-energy.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.