SAP has reported strong third-quarter earnings results and has confirmed an improved full-year business outlook.

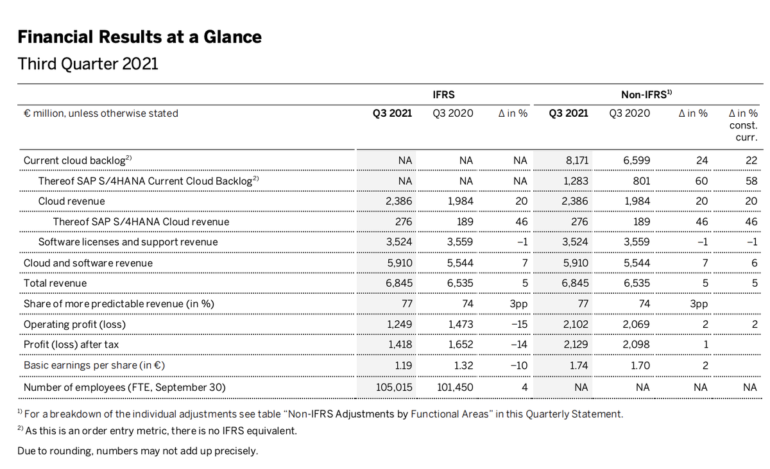

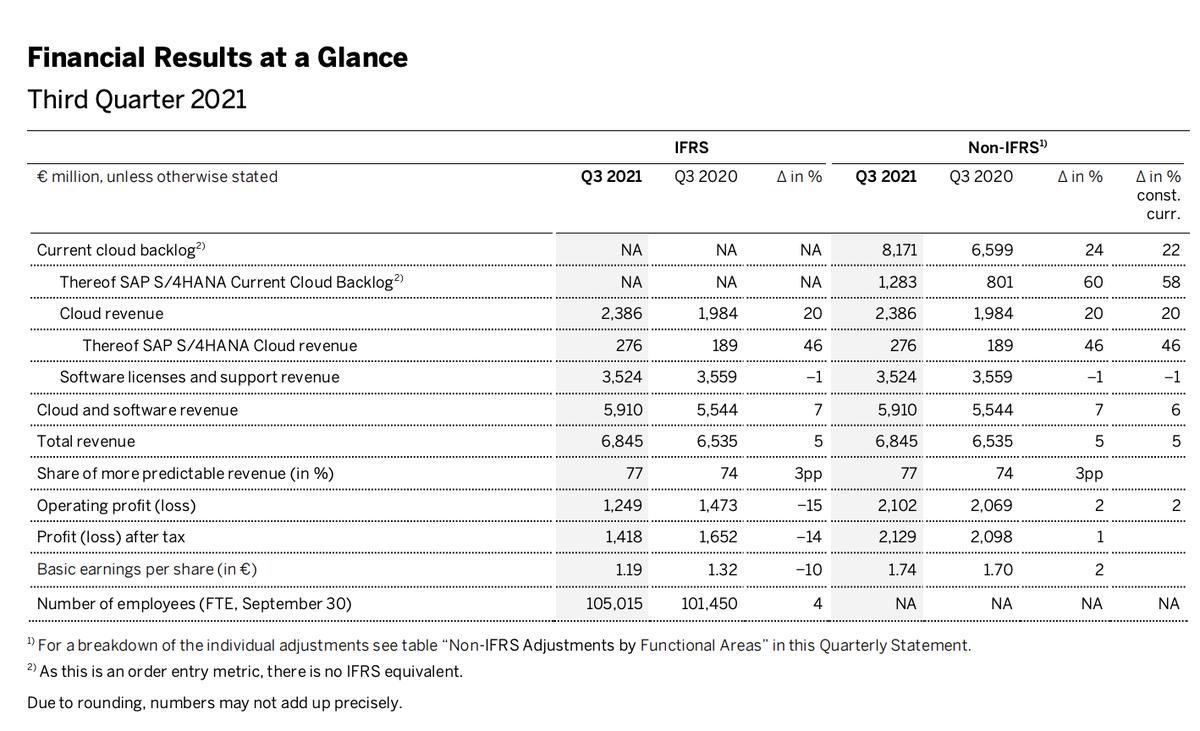

SAP’s Q3 2021 earnings (statement) (.PDF), ending September 30, 2021, reports revenues of €6.84 billion IFRS, up 5% year-over-year (up 5% at constant currencies) with basic earnings per share (EPS) of €1.19 (IFRS), or €1.74 non-IFRS.

In Q2 2021, SAP reported €6.67 billion IFRS revenue with basic EPS of €1.15 (€1.75 non-IFRS).

SAP reported an operating profit of €1.25 billion IFRS, down 15% year-over-year (non-IFRS up 2% to €2.10 billion). The firm’s operating margin has decreased by 0.9% to 30.7%. Operating cash flow was reported as €4.95 billion.

The vendor says the slide in operating profit is mainly due to “higher share-based compensation expenses” primarily related to Qualtrics.

Cloud revenue grew by 20% year-over-year, to €2.39 billion (IFRS), and up 20% at constant currencies. In the second quarter, SAP reported IFRS cloud revenue of €2.28 billion.

The RISE program has secured a further 300 customers. Software license revenue decreased by 8% year-over-year to €0.66 billion (IFRS and non-IFRS) and down 8% (at constant currencies).

“SAP is seeing continued strong demand and adoption of its ‘RISE with SAP’ offering which customers of all sizes, including an increasing number of large clients, are selecting to manage their business transformation. As more customers adopt this holistic subscription offering, software licenses revenue decreased as anticipated.” SAP says.

Overall cloud and software license revenue increased by 7% year-over-year to €5.91 billion (IFRS) and up 6% at constant currencies.

SAP S/4HANA added an additional 500 customers to the roster in Q3 2021, up 16% year-over-year. SAP S/4HANA now accounts for over 17,500 customers, of which approximately 11,400 are now live.

A current cloud backlog of €8.17 billion has been reported, with revenue up 22% at constant currencies. S/4HANA cloud revenue was up 46% to €276 million and up 46% (at constant currencies), with backlog up by 60% over the quarter.

SAP reports on three main business segments, “Applications, Technology & Services,” “Qualtrics” and “Services.”

Applications, Technology & Services revenue was reported as up 5%, at €5.76 billion year-over-year, or up 5% at constant currencies.

Qualtrics revenue was €233 million, an increase of 38% year-over-year, or up 39% at constant currencies.

Read more: IBM, SAP partner to move financial institutions to the hybrid cloud | SAP acquires machine learning tech company SwoopTalent | Google Cloud joins SAP RISE program

The Services segment, including digital transformation and the Intelligence team, reported revenue of €803 million, down 1% year-over-year and down 1% (at constant currencies).

SAP’s full year outlook has also been revised with improved figures. The company now expects non-IFRS cloud revenue to reach between €9.4 – 9.6 billion (in comparison to €9.3 – €9.5 billion) at constant currencies. Non-IFRS cloud and software revenue, at constant currencies, is now estimated as between €23.8 and €24.2 billion.

“This has been an excellent quarter across all key financial metrics,” commented Luka Mucic, SAP CFO. “We are seeing sustained, strong progress in SAP’s transformation. Our cloud business is growing at an accelerating pace and has led to our improved full year outlook.”

Previous and related coverage

Have a tip? Get in touch securely via WhatsApp | Signal at +447713 025 499, or over at Keybase: charlie0