The Digital Transformation Agency (DTA) has been working on Australia’s digital identity system for a number of years, going live with the myGovID — developed by the Australian Taxation Office — and accrediting an equivalent identity service from Australia Post last year.

The myGovID and the Australia Post Digital ID are essentially just forms of digital identification that then allow the user to access certain online services, such as the government’s online portal myGov.

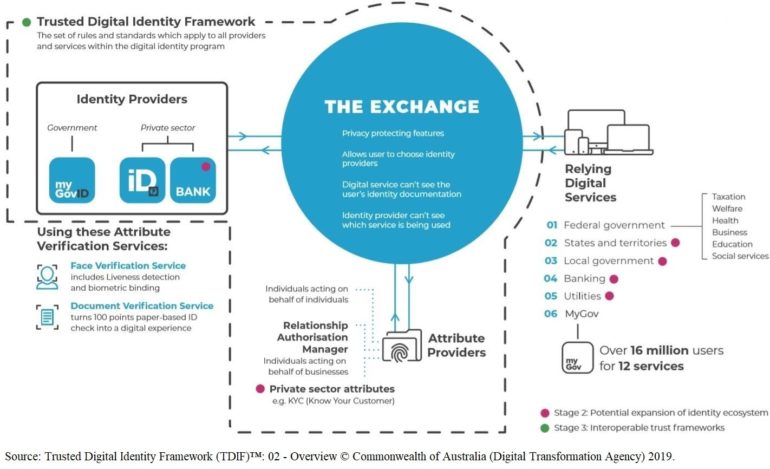

There has been conversation around extending digital ID to allow the private sector and state government entities to develop their own platform and DTA CDO Peter Alexander told Senate Estimates last week that the agency is moving forward with the plan.

“It is important to note, today we’re using myGovID, but into the future, you’ll be able to use a choice of identity provider, there’ll be additional providers … it could be a bank, it could be a state and territory identity provider. So individuals and businesses dealing with the Australian government and national services will be able to make a choice,” he said.

See also: More privacy conscious and not Australia Card 2.0: DTA defends digital identity play

In addition to adding more services to the myGov portal that can be accessed with a digital identity, the DTA is also looking to add a digital, biometrically anchored identity. Revealing this in March, Alexander last week confirmed the capability would allow users to simply take a photograph of themselves for it to be matched to a passport.

“In time, that will be able to match the other biometrics that are held like driver’s licences, working with vulnerable children — whatever biometric is held,” he said.

But the DTA is also working on legislation around the digital identity program.

“The Trusted Digital Identity Framework that sets out the operating model for digital identity sets the rules of operation, how participants in the ecosystem — identity providers, consumers will operate,” he explained.

“That is a set of rules that the federal government can follow and agencies in the Australian government can use but they can’t be applied to states and territories [or] to the private sector. We need legislation to do that, so we’re working on legislation and we’re about to go out to consult on that legislation at the end of this month.”

On running an awareness campaign on the digital identity program, Alexander said it would be “fairly minor”.

“The reality of digital identity and authentication services is as we roll them out, and as banks have rolled them out, as retail has rolled them out, authentication services, customers, and consumers just pick them up,” Alexander said.

“Generally, if they’re easy to use, they’re secure, and build competence through the process, people pick them up. They’re built in such a way that they aren’t complex, they aren’t time consuming.”