Eftpos has announced the purchase of Australian payments app Beem It from the Commonwealth Bank of Australia, the National Australia Bank, and Westpac.

The decision by the Australian debit payments company to purchase Beem It for an undisclosed amount is part of its plan to “continue to make inroads in the digital space”.

“We are very excited to complete this purchase as a key element to Eftpos’ strategy to diversify and move further into the digital ecosystem,” Eftpos CEO Stephen Benton said.

“Australians are rapidly moving much of their daily lives to mobile and Beem It is a great Australian-owned and operated option for them to embrace digital payments.”

In August, Eftpos made its first play in the digital payment realm with the rollout of its digital payment service to banks and retailers.

Prior to that, the payments company teamed up with distributed ledger firm Hedera Hashgraph to develop a micropayments proof-of-concept in hopes it could be used as an alternative payment to monthly subscriptions or paywalls.

At that time, Eftpos also announced it was teaming up with Australia Post to trial a new digital identity solution, ahead of its official launch before the end of the year.

Known as connectID, the service acts as a broker between identity service providers and merchants or government agencies that require identity verification, such as proof of age, address details, or bank account information.

The connectID solution, like the postal service’s Digital ID, was designed to work within the federal government’s Trusted Digital Identity Framework (TDIF) and the banking industry’s TrustID framework.

The trial followed a proof-of-concept with 20 other “well-known” Australian brands earlier this year.

Read also: Reserve Bank calls in big banks for Aussie blockchain-based digital currency project

Also, just last week, Eftpos launched its public API program, and announced through the program a partnership with local fintech Verrency, a loyalty program that gives Verrency cardholders access to rewards and discounts when making Eftpos transactions.

Benton said with the acquisition of Beem It now completed, the company will look to create additional payments solutions for consumers, merchants, and banks.

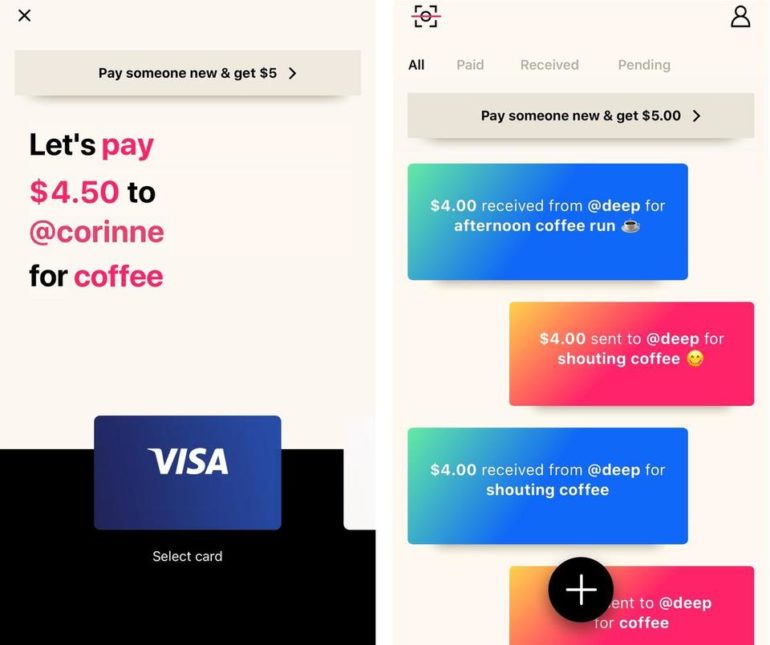

Beem It was launched back in October 2018 jointly by the three big banks, and enables users to send and receive money regardless of who they bank with through an interface reminiscent of a social media app.

“Under its new owner, Beem It will be able to take full advantage of the infrastructure, cost benefits, and partnerships offered by Eftpos, which will help it grow faster and expand the innovative services it currently provides,” a spokesperson for the big banks said. “We believe this transaction will secure Beem It’s future as a leading digital wallet provider and we wish the company and its team the very best for the future,”

Related Coverage

Samsung Pay goes live across the Eftpos network with Heritage Bank

Meanwhile, Eftpos has experienced 20% growth month-on-month across mobile transactions during the pandemic.

COVID-19 pushes Westpac to jump on Apple Pay

Westpac also announced it would be copping a AU$2.2 billion impairment charge in its first half financial results as a result of the global COVID-19 pandemic.

Square Terminal launches as company eyes bank-neglected space in Australia

Australia finally gets its hands on the Square Terminal, nearly a year after businesses in the United States.

Eftpos now accepts Google Pay across St George, Bank of Melbourne, BankSA

The payments network now accepts Eftpos CHQ and SAV payments on Google Pay for customers of St George, Bank of Melbourne, BankSA, ANZ, and eight Cuscal sponsored credit unions and banks.