Bitcoin SV (BSV) and Bitcoin Association confirmed this week that a 2 gigabyte (GB) block was mined on the BSV blockchain public network.

This is the largest block to date to be mined on a public blockchain, according to the Switzerland-based digital currency organisation. The block 700606 was recorded on August 16, 2021 at 15:20:11 (UTC), and contains 1,999,941,397 bytes of data.

This block earned the winning miner more in transaction fees than was earned from the current 6.25 coin Bitcoin block reward. Miners compete to mine a block and, if successful, receive a fixed subsidy, 6.25 coins in addition to the transaction fees for the mined block.

Larger blocks can contain more transactions (this particular block contained 5,869 separate transactions), with each network transaction paying a small fee to have the block mined.

The larger the block, and the more transactions in it, the larger the fee for the miner. In May 2020, the number of new Bitcoins entering circulation dropped by half – meaning that the expected revenue from each block also drops by half – from 12.5 to 6.25 coins.

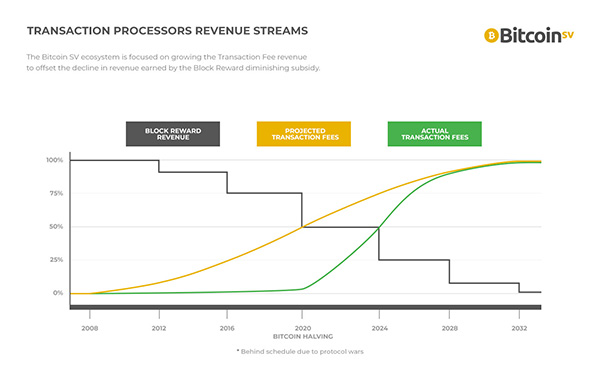

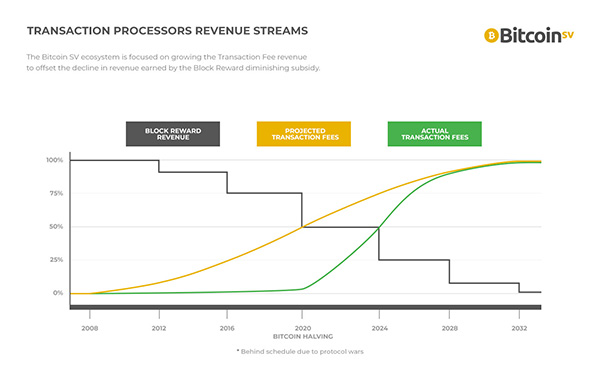

As each halving event happens approximately every four years, the expected block revenue will be cut in half, eventually reducing to near-zero. Growing the transaction fee revenue will offset the decline in revenue from the block reward.

Earlier in August 2021, the BSV blockchain mined five 1GB blocks, showing that large blocks can exist and be mined on the blockchain public network and not solely in isolation in a test lab.

Miners have raised their block size ‘hard cap’ limits to mine more and more of these larger blocks. Large blocks such as this 1.247GB block have been mined earning transaction fees (6.33 coins) that are higher than the fixed subsidy amount (6.25 coins) for the block, and giving a total reward for the miner of 12.58 BSV.

The appearance of another large (1.737GB block) shows that similar-sized blocks are starting to appear on the public blockchain. Blockchain-based identity protocol users of MetaID and applications such as ShowBuzz, upload larger-size image files to the blockchain and need larger blocks to operate.

What type of data the block contains is irrelevant. Data might include large video files, raw metadata – or even pictures of cats.

The block size is the key factor here, and the transaction fees, now at more than the block’s total reward for blocks this size, show that the landscape is changing towards transaction-rich blocks on the blockchain. A quick scroll down the list shows several blocks over 100MB being mined by different miners.

Miners earn fees for every transaction contained in a block, so as the transaction fee revenue increases over time it will compensate for the decreasing fixed subsidy amount.

If you are interested in the economics of how this works, see this explanation showing why the economics of network transaction fees are important.

Technical Director of the Bitcoin SV Infrastructure Team Steve Shadders said: “On the BTC network, it took years of Bitcoin scaling battles to get nowhere and remain restricted at 1 megabyte blocks that can handle 7 transactions per second.”

“On BSV, it took less than a week for miners to see value in opening the door to 2 GB blocks. While this sounds big, we are really just getting started on our journey towards terabyte – 1 million megabyte – sized blocks so that BSV can process millions of payment and data transactions per second.”

Users are starting to demand greater data capacity and miners want to to generate greater fee revenue, so expect to see more and more gigabyte-sized blocks appearing on the public blockchain.

Being able to transact large blocks and increase throughput to thousands of transactions per second will encourage enterprise adoption.

Imagine scenarios as diverse as fast moving consumer goods (FMCG) organisational asset tracking, music or film library storage with user download and tracking, or IoT data warehousing for consumer products.

There is even scope for an integrated healthcare system that can store all patients entire healthcare history and prescription records throughout their whole lifespan – all stored permanently as immutable data on the blockchain, owned by the patient themselves.

Scaling Bitcoin with bigger blocks containing more transactions and data, and minimising transaction fees will ensure that ordinary users of the blockchain will use it for everyday activities and contribute to its everyday adoption and ultimate growth.