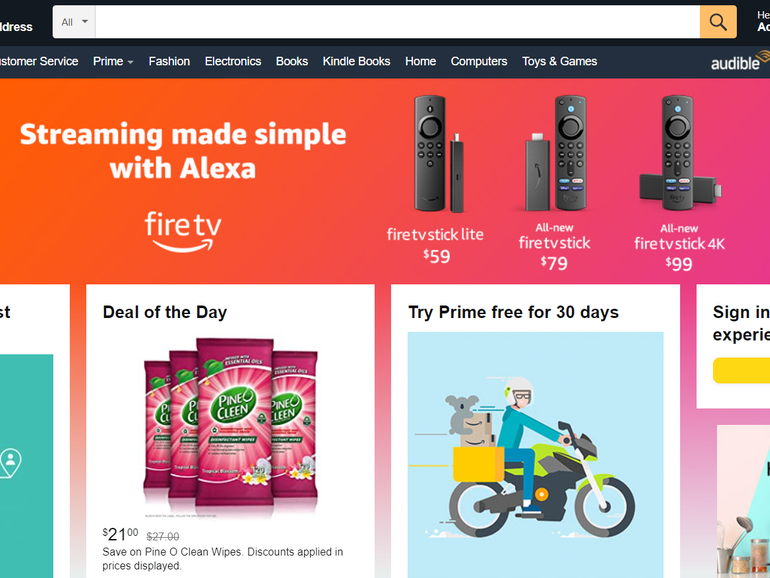

Online retail marketplaces operating in Australia such as eBay, Amazon, Catch.com.au, and Kogan are the latest companies to fall under the Australian Competition and Consumer Commission’s (ACCC) microscope, with the watchdog concerned about potential competition and consumer issues within that space.

After announcing in August it would be heading down this route as part of its Digital Platform Services Inquiry, the ACCC on Thursday released a new issues paper [PDF] that hopes to gather information on online retail marketplaces, ahead of preparing a report for the Treasurer in March 2022.

“While general online retail marketplaces provide benefits to sellers and consumers, concerns have been raised to the ACCC about the conduct of some marketplaces and the risk of harm to both sellers and consumers,” it said. “These include concerns relating to the display of seller goods and timeliness of payments for sellers; and for consumers, the level of support provided by marketplaces when disputes arise as well as goods quality issues.”

The ACCC said it is also cognisant of potential future risks posed by online marketplaces “due to their ability to perform a gatekeeper role, enabling them to exercise a degree of market power and extract increasing value from sellers and consumers, potentially increasing prices”.

See also: Kogan fined AU$350,000 for offering ‘discounts’ on products with inflated prices

Specifically, the watchdog wants to understand the potential competition and consumer protection issues from the perspective of sellers, consumers, and anyone else that considers themselves relevant to the inquiry.

Concerned with Amazon’s competition squeeze, the ACCC is asking for feedback on the extent to which online marketplaces compete with the third-party sellers that are selling directly from their own online stores.

It is also asking if competition, or potential competition, in the supply of online marketplaces services been affected by acquisitions of tech platforms and companies, including startups, the acquisition or development of new tech, and the expansion into Australia for international businesses.

The ACCC will also consider the degree to which brick and mortar sales, online sales direct from a retailer’s website, comparison or referral services, and classifieds competitively constrain general online retail marketplaces.

Rounding off its 37 questions, the ACCC is keen to explore the increased collection and use of consumer data and the more precise targeting of consumers enabled by that collection.

“The collection and use of data associated with consumers (including data from both the marketplace and other sources) can benefit sellers and general online retail marketplaces by allowing them to tailor offerings to the consumer, allowing consumers to see products that may be more relevant to them; however, it also increases the risk of harm to consumers from exclusionary targeting (ie businesses deliberately not serving ads to those consumers or a segment to which the consumer belongs), exploitation, and price discrimination,” the issues paper says.

“In addition, the ACCC is aware of concerns raised in other countries about some digital platforms using data collected from third-party sellers to advance their own products to the potential detriment of rivals.”

The ACCC is therefore seeking information about the amount, and type, of data collected during a consumer’s use of these platforms, including who has access to that data and the degree of transparency provided to the consumer about how marketplaces and/or third-party sellers use that data.

For 2020, eBay Australia reported AU$6.5 billion in gross sales revenue, Amazon reported AU$2.6 billion, Kogan with just shy of AU$1.1 billion, and Catch generated AU$610 million.

The ACCC is accepting submissions until 19 August 2021.