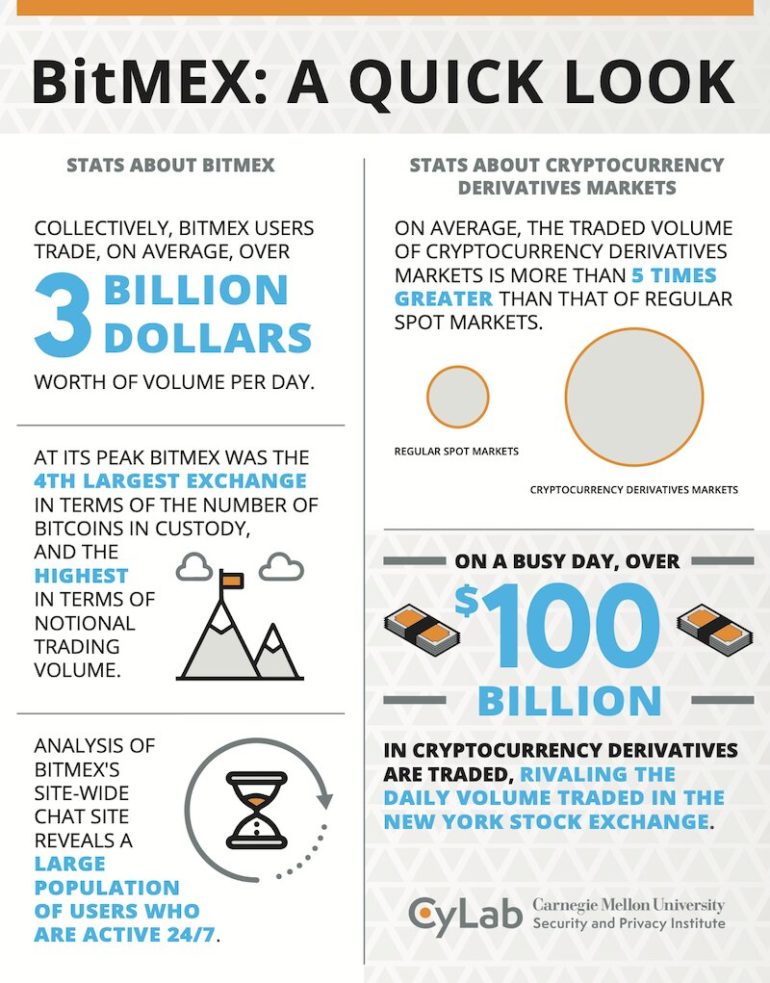

Markets for cryptocurrency derivatives—contractual side-bets on the future price of cryptocurrencies—have exploded in recent years. On a busy day, over $100 billion in these derivatives are traded, rivaling the daily volume traded in the New York Stock Exchange. What’s more, there is evidence that the activity inside these markets may affect the value of cryptocurrencies themselves.

These are a few of the findings of a first-of-its kind study by Carnegie Mellon University CyLab researchers, which were presented at this week’s The Web Conference, held virtually in Ljubljana, Slovenia.

“On average, the traded volume in cryptocurrency derivatives markets exceeds the regular crypto spot markets by a factor of five,” says CyLab’s Kyle Soska, a Ph.D. student in electrical and computer engineering and the study’s lead author.

In their study, the researchers performed a comprehensive analysis of BitMEX, a derivatives exchange that initially launched in 2014 and would become one of most successful exchanges by volume traded. Performing analyses on publicly-available data from BitMEX, the researchers were able to put together the first comprehensive look into the massive amounts of activities that occur in these types of markets.

As a companion to their study, the researchers built and released a public website that provides a live record of BitMEX and provides real-time access to their analysis platform for other researchers, economists, and interested parties.

“Derivative markets are important because their behavior influences the price dynamics of cryptocurrencies themselves,” says CyLab’s Nicolas Christin, a co-author of the study and a professor in the Institute for Software Research (ISR) and Department of Engineering and Public Policy (EPP).

Christin describes this as a bit like a chicken-and-egg problem. People could use derivative markets to hedge against certain price movements, he says, but in turn, derivative markets with high leverage may create instability cycles: volatility in cryptocurrency prices then causes more liquidations in derivative markets, which results in volatile cryptocurrency prices.

An analysis of archived messages in BitMEX’s site-wide chat room illustrates a highly diverse population of traders. Most interestingly, messages in Korean—the vast majority presumably originating in Korea, which encompasses a single time zone—were almost time-invariant. In other words, while one would expect activity to occur during normal “daytime” hours, the chat analysis suggests that a large population of Korean traders were active 24/7.

“There’s this quote, ‘Money never sleeps,'” says Christin. “… But Wall Street mainly trades between 9:30 a.m. and 4 p.m. In these cryptocurrency derivatives markets, we see data that show people in the same time-zone trading every minute of the day.”

Trading on BitMEX and other cryptocurrency derivatives markets is a high-risk, high-reward endeavor. First, traders can use what’s referred to as “leverage,” meaning that they can wager a much larger bet—commit to a much larger position—than they can cover with the funds currently in their account. This can yield huge wins, but also immediate losses.

Adding to the risk is the fact that unlike traditional currency markets, all one needs to trade on cryptocurrency derivatives platforms is a valid email address, some cash, and a few minutes’ time.

“Our data show really small positions in these markets—likely held by people with not a ton of experience—being disproportionately liquidated,” says Soska. “Our findings suggest a familiar story in a relatively new and burgeoning market: that really sophisticated people show up and have a significant edge over amateurs.”

Looking forward, Christin says that cryptocurrency derivative markets are beginning to dwarf normal markets, and this affects not just those steeped in the crypto world, but even those outside of it.

“These markets are becoming more mainstream, whether we like it or not,” Christin says. “Even if you personally aren’t interested in cryptocurrencies, it’s possible your financial advisor or a firm trading on your behalf will be soon.”

This study was a collaboration between researchers at three different colleges at Carnegie Mellon University—the College of Engineering, the School of Computer Science, and the Tepper School of Business.

Study detects lottery-like behavior in cryptocurrency market

More information:

Towards Understanding Cryptocurrency Derivatives: A Case Study of BitMEX, cylab.cmu.edu/_files/documents … g-cryptocurrency.pdf

Provided by

Carnegie Mellon University

Citation:

Cryptocurrency derivatives markets are booming: study (2021, April 19)

retrieved 19 April 2021

from https://techxplore.com/news/2021-04-cryptocurrency-derivatives-booming.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.