The supply chain for edge computing services bearing cloud providers’ brands, made available to enterprises of all sizes through telecommunications providers (“telcos”), is coming together quickly. Smaller data centers across the continent, linked together using the fiber-optic network that will empower 5G Wireless, could bring clouds closer to customers.

HPE’s 2015 model Micro Datacenter, which the company promised then would be a harbinger for MEC.

Hewlett Packard Enterprise

Here’s the big question: Is telco-flavored edge computing something that a broad cross-section of computing customers will find a good reason to want? The problem with any technology carrying the “5G” brand is that, while it may yield architectural improvements and cost benefits for the telcos responsible for it, consumers have yet to discover substantive reasons to fall in love with it.

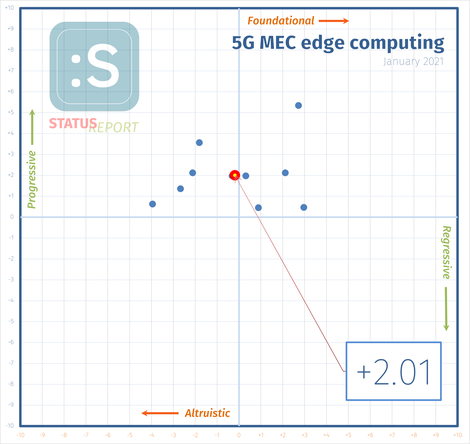

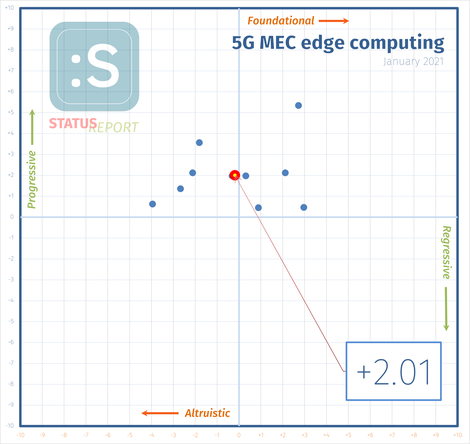

This is the latest edition of Status Report, ZDNet’s ongoing series that systematically evaluates the potential for technologies to exhibit genuine influence in their markets, and the world at large. For each technology, we look at the same ten categories of influence, and rate the progressive and regressive potentials separately on positive-10 and negative-10-point scales, respectively. Then on a 2D Cartesian chart, we give each category its own compass direction, or vector, plot the position of each influence point on that vector and compute the geometric average location of all points. The distance of that average point from the dead center is our final influence score.

Executive summary

Before we reveal our scores for Multi-Access Edge Computing (MEC), let’s summarize the main points that our examination of 5G edge computing reveals:

Point 1: MEC’s proponents aim for it to become 5G’s raison d’être

From the standpoint of official standards, MEC is not a 5G technology. Rather, it was advanced by the European industry standards group ETSI, as a way to deploy an application to a remote site, and route traffic to that application through the telco network. We’re not talking about containerization here, although the one thing MEC architecture does have in common with Kubernetes-style orchestration is that they both perceive an application as a secured network endpoint. Thus, a service may address an application directly.

The components of 5G that govern how an application becomes addressable through a telco network, are what 3GPP calls Application Function (AF, for when the application is trusted) and Network Exposure Function (NEF, when it’s not trusted and there needs to be a proxy or “aggregation point”). The way ETSI sees it, MEC “maps” itself onto AF/NEF — meaning, MEC does what 3GPP architecture would expect AF/NEF to do. It also maps itself onto 4G LTE architecture, through a clever architectural alternate pathway.

There’s a word for when a superpower liberates your territory from you: annexation. With respect to whether ETSI may be effectuating its own form of “regime change,” in an August 2018 blog post entitled “MEC: Your guide into 5G,” ETSI’s MEC group chair and Hewlett Packard Enterprise technologist Dr. Alex Reznik rather smugly put it, “We all have our job to do, and what 3GPP and ETSI MEC do is by and large complementary.”

In that same blog post, Dr. Reznik argues that 5G is actually about applications, whereas all the other stuff about New Radio and infrastructure may be, from the perspective of history, appendices — or in his words, “just tools.” As the designated representative of the MEC effort, Reznik has declared the goal of his group’s edge computing standard to be the entire point of 5G’s creation. If ETSI’s dream comes to fruition, all the world’s applications will be vastly distributed and deeply embedded throughout billions of small server clusters, many of which will reside on customers’ premises, many others in micro data centers (µDC) deployed next to, or even inside, 5G base stations.

Point 2: From the edge to the customer, it’s a jump ball

In telecommunications, there has long been a concept called “the last mile:” the connection between where the carriers’ equipment terminates, and the wire connects to the home or office. Technically, MEC reference architecture stops at this termination point, opening up what telco’s call a point of presence (PoP). But because customers need to see that gap filled by something, MEC’s vendors are coloring, if you will, past the borders.

In July 2020, it appeared that the next generation of unlicensed wireless access, called Wi-Fi 6, would be competing against a technology promoted by Qualcomm called NR-U — an extension of 5G New Radio (NR) for unlicensed spectrum. My initial profile of NR-U for ZDNet was entitled, “5G and Wi-Fi 6: Unlikely allies.”

As if to show me up for a chump, Aruba advanced a platform for MEC that utilizes Wi-Fi 6 for indoor wireless connectivity and NR-U for outdoor. “The bottom line is that any Wi-Fi versus 5G narrative misses the point,” reads a company blog post. “Wi-Fi and cellular (5G) are both evolving to better serve end-users, and both markets will grow to serve the macro trend of connecting and analyzing devices.”

From the customer’s vantage point, the PoP should be whatever the user is touching, not some box a mile away. Manufacturers do offer case studies. Right now we’re seeing a plethora of stadiums and arenas, and even more stadiums and more arenas — not nearly enough branch offices and research facilities. My guess is, nobody leaves a hockey game thinking, “Wow, I just texted Mom and Dad pictures from the Bruins game using MEC!”

Edge computing, as originally conceived, connects all the dots. For MEC to do the same thing, enterprises will need to resolve the issue of which technology completes the proverbial last mile.

Point 3: Which edge we’re talking about, remains a point of confusion

There’s an established market around edge computing, and it’s already healthy. Entire analysts’ reports, customer meetings, and (virtual) conferences are centered around the topic of edge computing — all without even mentioning MEC.

Either MEC is the most disruptive thing since Roberto Benigni walked over the tops of chairs at the Oscars, or it’s not even on anyone’s radar (except perhaps ours). This matters because the enterprise customer will be the one choosing the final edge computing solution. If that choice tends towards MEC, it must be for a compelling reason. Right now, MEC’s champions — which include Qualcomm, Cisco, and Aruba — are touting its ability to push applications out from the cloud, to what they consider the customer.

Problem is, it’s not the same customer. Enterprises — which are made up of people more than servers — have to want this, otherwise, we’re just spinning our wheels here.

Sphere of influence

Here are the influence scores that lead us to the above revelations:

Stakeholder empowerment

Empowerment is a very different concept from enrichment. With the former, a technology enables its benefactors and practitioners to build an industry and a livelihood from it.

If MEC succeeds, it could become one of the strongest components in the 5G portfolio [+7]; if it doesn’t, the 5G portfolio could, to borrow a phrase, disavow any knowledge of its actions. Along the way, there’s enough there in MEC to launch an industry. Remember, back when two cellular technologies were claiming to be 4G, the other one — WiMAX — declared victory over LTE several times. There was a decent industry around WiMAX (just as there was around HD DVD and DVB-H). . . until there wasn’t one. The downside risk for MEC is significant, but for the moment, not prohibitively so. [-4, net: +3]

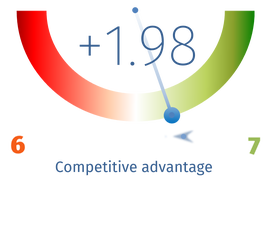

Competitive advantage

MEC would put telcos squarely in the cloud computing business, not as cloud service providers (it’s too late to start a new Amazon) but as what could be called “cloud carriers.” AT&T aims to become a Google Cloud carrier, while Verizon has plans to carry Microsoft Azure as well as Amazon AWS. The opportunity here is to bring cloud compute functions close enough to the customer to eliminate most latency, and potentially re-introduce the level of determinism needed for high performance. That’s more of an improvement than innovation, but it may still be worth paying for. [+7]

Whether this constitutes a genuine advantage depends on whether data center colocation providers and others in the existing edge space are capable of meeting or even exceeding MEC’s service levels. [-6, net: +1]

Business sustainability

Although MEC is being discussed in conjunction with 5G, MEC’s success is not tied with that of 5G. It could be deployed now — as ETSI makes clear, it “maps itself” onto 4G just as well. This gives not only carriers but vendors and service providers operating on carriers’ behalf, the opportunity to build a viable business model. [+6] Theoretically, if MEC loses out in favor of more customer-centered edge computing models (where the edge is defined by the customer), these providers could simply pivot to whatever model does prevail, without too much damage. [-3, net: +3]

Evolutionary incentive

Here is where the potential for change is enormous. Telcos purchase equipment in huge bulk. As Facebook has already demonstrated with its Open Compute Project, a company with huge purchasing power in its market can dictate the form factor and contents of what it buys. The texture and composition of a server, or server rack, geared for MEC could be very different from a typical x86 server box or blade, and that could open up new avenues for alternatives using Arm-based architecture. [+9]

While existing edge computing services have already produced differences in server form factors, it’s unlikely that their requirements for servers, and MEC’s requirements, would diverge too greatly from one another. Indeed, having both market segments duking it out against each other may only yield cumulative benefits. [-3, net: +6]

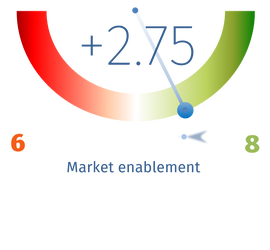

Market enablement

There will very likely be a viable enterprise edge computing service market, one way or the other. Having perfected utility business models for greater than a century, telcos know how to do this part. [+8] In fact, edge data center providers may be waiting for telcos to define a viable utility model, before making their own next move. [-6, net: +2]

.

Customer value

This is the big question mark. A platform only succeeds when it becomes the reliable provider of a suddenly indispensable service. If it’s not the exclusive provider of that service, then it had better be distinguished. Edge computing is just now being understood to be a necessity, the optimum compromise between having one’s computing and data assets conveniently nearby, and outsourcing their management. MEC would be a breakthrough if someone else wasn’t already breaking through. If telcos and cloud providers can jointly focus on the convenience factor, they have a real opportunity to pull this off. Plus, typically, there’s an upside for having competitive platforms in a market space: It attracts attention. Or at least it should. [+7, -5, net: +2]

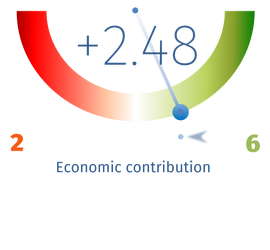

Economic contribution

MEC is an infrastructure project. It could drive demand for fiber optic connectivity for the enterprise, and in so doing, spur investment in the types of public works projects that hire good people. [+6] If MEC doesn’t catch on, it’s not a wasted effort since 5G Wireless needs that connectivity for backhaul anyway. [-2, net: +4]

.

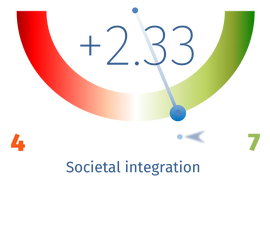

Societal integration

Again, the potential here — if MEC’s practitioners achieve their goals — could be enormous. Imagine small towns and rural districts where there are two intersections with stoplights, one post office, maybe the last video rental store in the state, a data center, and a small network of 5G base stations. If the only revenue incentive for building 5G in rural areas was expanding cellular coverage, that critical break-even point may be far, far away. But if the municipalities in these areas co-owned and operated their own data centers, and resold services to local businesses, local economies could have greater reason to thrive. [+7] In the negative, if telcos don’t pull this off, municipalities could be looking at even more neglected facilities and abandoned buildings, alongside certain vacant mega-marts. [-4, net: +3]

Cultural advancement

I’ve referred to municipalities. Let’s take this one step further: MEC has an opportunity to contribute to the nation’s educational infrastructure in a way enterprise edge computing, through private data centers and exclusive connectivity providers, would never have considered. Imagine millions of kids not only with tablets, but also an open channel of learning and public discourse. [+5] There is always the possibility, though, that such an effort may end up resembling all the previous ones. Insert your choice of references here to history repeating itself. [-2, net: +3]

Ecosystemic enablement

There is already a strong industry in cloud-native computing, which refers to enterprises’ capability to develop, test, and deploy their own applications on a distributed cloud platform. Edge computing by itself does not necessarily result in enterprises’ IT assets becoming their customers’ distributed cloud platforms. But if MEC can solve the problem of getting its ends straight for “end-to-end,” while it’s wiring up small businesses for connectivity, it could be gearing them up for cloud-native deployment, setting them up with automated tools and managed Kubernetes. [+8] The downside there is that, once such a platform generates demand from the customer rather than just toward, existing edge providers may be able to offer something very similar, resulting in price competition. [-4, net: +4]

Final score: +2.01

In no single category of our examination did MEC post a positive score lower than +5, and its highest negatives were only +6. There were no net negatives. And the left and right sides of the chart were almost evenly distributed. So are we being fair in our assessment? It’s because the foundational side and the altruistic side of the scores pull against one another, that we end up with barely over +2.

The truth is, that’s a strong closing score. Obviously, MEC has clear downsides to overcome. But first and foremost, it has to resolve the customer value question. MEC’s practitioners have yet to make clear and convincing arguments for the customers of telcos — up to now, their marketing has been directed almost solely to telcos. We don’t know yet why MEC will benefit end-users, over and above what a micro edge data center, or even a relatively small facility such as one managed by EdgeConneX, can offer them. Once again, someone has to pave the last mile, light it up, and throw a party there. Otherwise, we won’t see it happen. And that would be as good as it never having happened at all.