Salesforce is reportedly in advanced talks to buy Slack with the aim of bridging collaboration with its sales and service clouds and expanding its reach, but the purchase is about playing defense as much as offense.

It’s hard to view Salesforce’s potential purchase of Slack as reported by the Wall Street Journal in a vacuum. This deal isn’t about product roadmaps and growth as much as it is competitive landscape. Sales and service have gone virtual amid the COVID-19 pandemic and will largely remain that way. Yes folks, travel budgets for sales teams aren’t going to come all the way back amid remote work.

Salesforce’s biggest CRM rivals have collaboration platforms. Microsoft has Teams and its integration with Office 365 and a platform play. And Adobe just acquired Workfront and can integrate that project management platform with its clouds. Communication and customer experiences are merging: Note that Twilio’s $3.2 billion purchase of Segment illustrates the trend.

The competitive axis in CRM is Microsoft with partners like Adobe and C3.ai vs. Salesforce.

Salesforce has yet to nail the collaboration game. Salesforce launched Chatter in 2009, bought Quip in 2016 and just rolled out Salesforce Anywhere, but lacks the reach of Slack.

Nevertheless, Marc Benioff, CEO of Salesforce, has had a love affair for communication and collaboration for years. He even floated acquiring Twitter, but shareholder reaction thwarted the deal. Benioff lost out on LinkedIn, which was acquired by Microsoft.

For its part, Slack hasn’t grabbed share amid the move to remote work. Zoom has become the collaboration darling as video conferencing moved to the front of the stack. Microsoft Teams offers Slack-like features with better video communications. You could argue Slack is on its heels and in need of a buyer with scale.

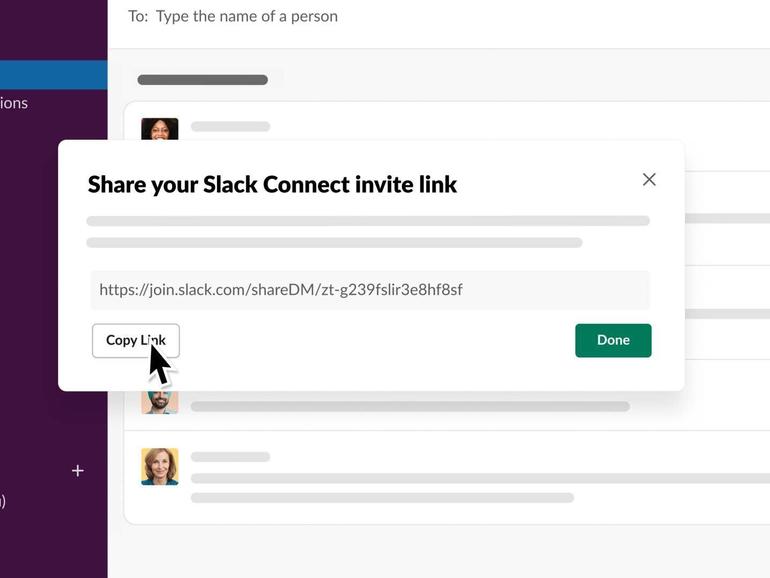

Slack’s ability to bridge companies and partners via its Slack Connect would be critical to Salesforce, which has Customer 360 but largely stays within the confines of the enterprise. Salesforce’s purchase of Slack gives it more heft vs. Microsoft and plays in a broader theme of Salesforce as the connector on multiple fronts such as applications (MuleSoft), analytics (Tableau) and collaboration (Slack).

Simply put, Microsoft with Teams, Dynamics and Office 365 can connect customers, vendors and partners. Salesforce needs the same and could use Slack Connect to be the glue of the sales process.

This vision was outlined by Slack CEO Stewart Butterfield during the company’s second quarter earnings conference call Sept. 8. Butterfield was asked about Slack Connect and how it connects multiple enterprises. He said:

The use cases that I’m most excited about are sales-related. Because, it’s actually just really good. I mean it’s great to have — for a complex sales process, which can involve legal negotiations and security reviews and the vendor approval process and all of that stuff to have the leaders, the managers on the sell side and the buy side both kind of have oversight of the conversations that are happening. There’s a lot less duplicative work. It’s much easier to bring someone in, all the reasons that channels are better.

But the other reason why I like this use case is because that’s an argument to buy Slack, get revenue, which is different than buy Slack, get productivity. I’m 100% sure that the ROI on the productivity sale is massive, like 100x or something like that because we don’t actually charge that much in the grand scheme of things. But of course, that’s always a harder sale to make whereas buy our product, get revenue is a lot easier.

Butterfield’s explanation sounds very Salesforce-ish. What Slack doesn’t have is the scale to be included into larger purchases. Slack is a point purchase today. Salesforce would change that buying cycle overnight.

What analysts are saying

The reaction to a Salesforce-Slack combination is a bit mixed. Here’s a quick survey:

Cowen analyst J. Derrick Wood said:

Collaboration is becoming increasingly important as COVID-19 has potentially permanently altered the way in which enterprises operate and communicate. As it stands today, Quip is CRM’s only touchpoint to collaboration, but MuleSoft provides broad-based integration capabilities across a wide variety of disparate applications. One of Slack’s main strengths is its ability to integrate many applications into Slack to allow for greater access control from one UI environment, ultimately allowing sophisticated end-users to streamline and automate workflows.

As (Slack’s) Shared Channels take greater hold, this feature could be used to further Salesforce’s vision of Customer 360. Ultimately, we see Salesforce wanting to fend off Adobe, Microsoft and other communication software players, and this would be an offensive move to do such a thing.

Stifel analyst Tom Roderick:

A “Collaboration Cloud” would present Marc Benioff with yet another massive horizontal total addressable market that is appealing to both enterprise customers and Mid-Market/SMBs and the addition of Slack’s CEO Stuart Butterfield to Salesforce would bolster the executive ranks with another top-notch exec. With Microsoft finding great success with its Teams offering this year, combining collaboration and video conferencing with its ubiquitous Office365 offering, Microsoft has positioned itself very well for the corporate productivity sale. The tie-up between Salesforce and Slack would position well for the “democratization” of enterprise software in a similar manner.

Evercore ISI analyst Kirk Materne:

The rationale for the combination is pretty simple: Slack would provide CRM a more robust collaboration engine to power its Customer 360 vision (remember Chatter?) and Slack would benefit from leveraging CRM’s enterprise sales organization and customer base. There will be some other nuances around Slack Connect and collaborative commerce, but the problem is even with Salesforce’s heft in the enterprise market, competing with Microsoft Teams in its core market is going to be extremely difficult and convincing investors of the merits of this deal will be challenging.