The second wave of COVID-19 hitting many countries together with companies preparing for longer-term remote-working environments have pushed PC shipments to levels not seen since 2011, according to analyst firm Canalys.

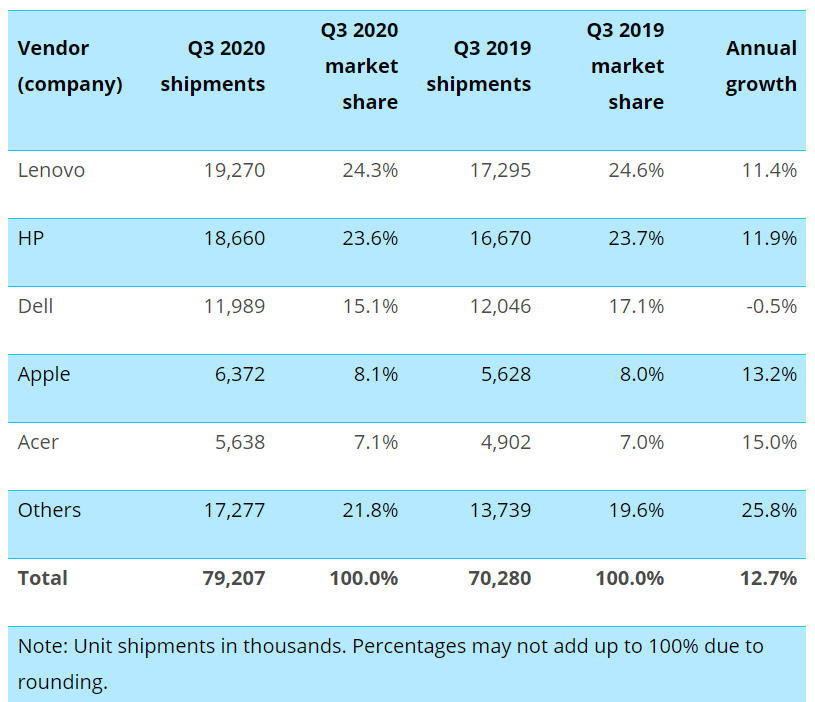

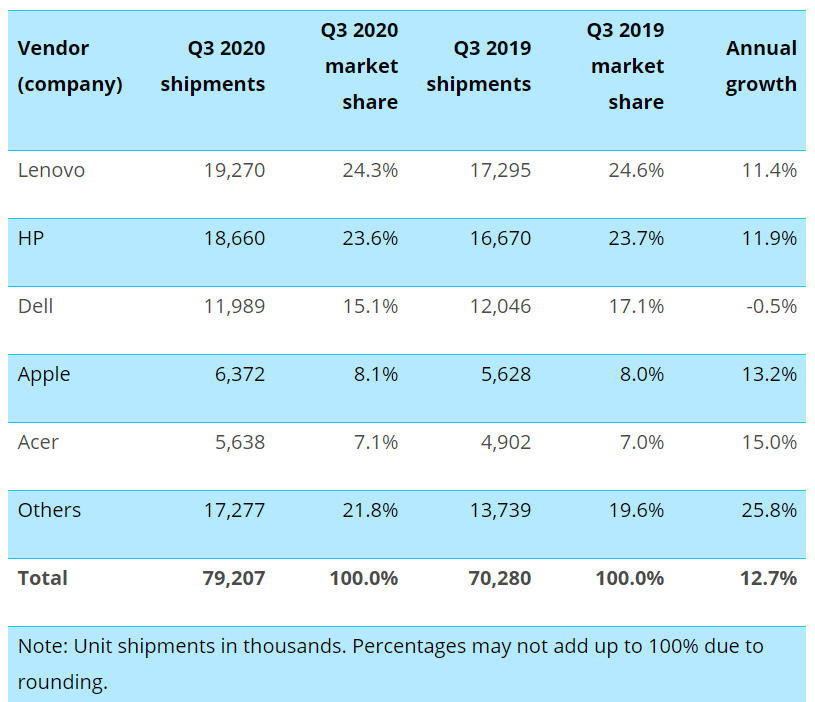

Worldwide notebook and mobile workstation shipments in the third quarter were 28.3% higher than a year ago, helping push overall PC shipments up 12.7% year on year to 79.2 million units.

According to Canalys, the industry shipped 64.6 million notebooks. Canalys’ notebook figures include Chromebooks but not tablets or detachables.

However, the shift to remote working pushed desktop shipments down by 26% compared with a year ago.

This quarter’s growth in PC shipments surpassed the 9% year-on-year growth in Q2 2020 PC shipments.

The pandemic has brought mixed results for Microsoft, which reported slowing demand from smaller businesses but bigger spending from large companies in Q4 FY20.

Stalled smaller companies and business closures resulted in Windows OEM professional revenues declining 4% year on year, while Windows OEM non-professional revenues were up 34% in the quarter.

On other hand, people are spending more time on their computers. In May, Microsoft Windows and Devices chief product officer Panos Panay said “over four trillion minutes are being spent on Windows 10 a month, a 75% increase year on year”.

Lenovo shipped the most PCs in Q3 2020 with 19.27 million units, up 11.4%, leaving it with a market share of 24.3%. HP shipments grew 11.9% compared with last year to 18.66 million units, resulting in a 23.6% share of the PC market.

Dell shipped 11.99 million units and has a market share of 15.1% but its shipments were down 0.5% compared with a year ago.

Apple’s Mac shipments grew an impressive 13.2% to 6.37 million units, giving it an 8.1% share of the PC market and fourth position. Acer’s shipments grew 15% to 5.64 million units.

Apple’s next earnings update is scheduled for October 29. The company reported Mac sales of $7.08 billion at its Q3 update in July, up 22% compared with a year ago. iPad sales were also up 31% to $6.58bn.

“Vendors, the supply chain, and the channel have now had time to find their feet and allocate resources towards supplying notebooks, which continue to see massive demand from both businesses and consumers,” said Canalys analyst Ishan Dutt.

Canalys reckons remote working will demand vendors focus on mobility, connectivity, battery life, and display and audio quality. The company also sees growth in computing for the education market and mainstream gaming.

Next quarter also looks set to bring positive news as consumer spending during the holiday season boosts computer sales.

PC sales have grown 12.7% from a year ago, recording the highest growth for 10 years.

Image: Canalys

Lenovo has regained top spot in the PC market in Q3 with growth of 11.4%.

Image: Canalys