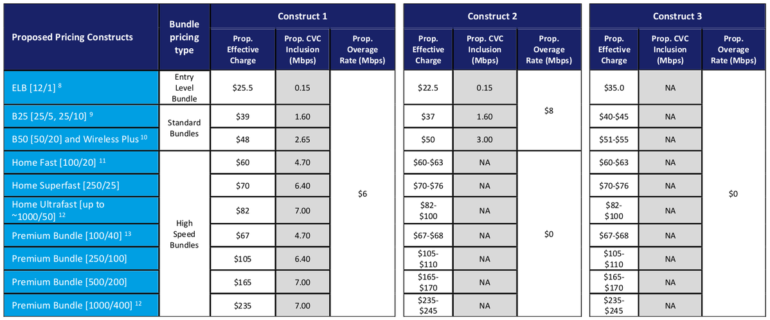

NBN’s pricing options: a reworking of the current model; its melded halfway house model; and its flat price model.

Image: NBN

The company responsible for the National Broadband Network has revealed the flat-price modelling it has been working on as part of a trio of pricing options to retailers.

The flat-price option would see the loathed connectivity virtual circuit (CVC) capacity charge removed from all plans, with access pricing increasing as a result.

NBN is also putting forward a reworked option of its current pricing structure, with the CVC charge dropping by AU$2 to AU$6, and a melded option that removes the CVC on plans of 100Mbps down and quicker, while keeping the current AU$8 CVC charge on lower speeds.

Satellite connections have not been considered as part of the discussion paper to modify NBN’s Special Access Undertaking released on Monday.

“All three options substantially address many of the concerns that have been expressed by retailers and provide a pathway forward to delivering a sustainable long-term pricing framework that supports the industry and meets the future digital needs of Australians,” NBN said.

“While we are aware of some retailers’ preference for a flat AVC-only construct, NBN Co believes careful consideration needs to be given to the potential impact on affordability of the broadband network for low usage customers, equitable cost recovery between consumer segments, take up of NBN services, retail competition, and consumer choice.”

Citing a report written for it by Accenture, NBN said the flat-pricing option would see price hikes of AU$120 a year for the 1.4 million customers on low data plans.

“NBN is concerned that [flat-pricing] would not deliver a number of outcomes that usage-based charges were designed to achieve, and would impact not just the affordability of the NBN broadband network for low usage customers, but also the take up of NBN services,” it said.

“NBN estimates that between 69,000 to 170,000 end-users would no longer be able to afford or be willing to take-up NBN broadband under [flat-pricing], primarily as a result of the removal of data-capped plans in market and retail price increases. The initial pricing proposal … has been adjusted to account for potential losses in NBN take-up.”

The company added that in exchange for losing revenue from CVC, it would turn to indexation to recoup its investment.

“In general, NBN proposes that where the pricing proposals outlined in this paper restrict or entirely remove NBN’s ability to recover its costs through usage-based charges in the form of CVC as applied to increasing bandwidth usage, NBN should have the opportunity to recover those costs by increasing fixed charge pricing components in real terms (i.e. an increase above the rate of inflation, reflecting the rapid growth in usage and hence capacity),” it argued.

“This is critical to allowing NBN the opportunity to generate additional revenue to recover efficient existing and future investments needed to sustain growing bandwidth requirements as well as network upgrade programs to uplift the capability of the network. This approach also reflects that the increased utility derived by end-users of the service as their usage of the network increases should be appropriately reflected in the revenues that NBN is able to earn.”

It added that removing CVC would result in traffic surges, such as when popular games are updated, and said it would need extra safeguards to manage capacity

NBN said for its melded option, due to telcos having data caps and entry level pricing plans sitting below the 100Mbps mark, it would expect retailers to have “little to no overage exposure”.

See also: Best internet provider in Australia 2021: Top ISP picks

On entry level pricing, NBN said there was not strong evidence for 20% annual increases on data inclusion on 12/1Mbps plans. It said it has noticed CVC utilisation on such plans was shifting downwards as some customers moved to higher speeds and was well below the 1.7Mbps deemed suitable for a AU$35 bundle.

“NBN understands that providing pricing certainty on entry-level services is important, and that price controls on these services can provide a meaningful anchor on prices of higher value services,” it said.

“Accordingly, we are proposing a price control of CPI for entry-level services, to enable the price to remain constant in real terms over time. In addition, we are proposing to commit to increase CVC inclusions on the [entry-level bundle] based on the actual usage growth of end-users on that service.”

For some time the Australian Competition and Consumer Commission (ACCC), which oversees the undertaking, has expressed concern at NBN’s use of discounts. NBN said in its paper that discounts allow it to trial pricing changes before offering them.

Written submissions to NBN from those that make up its product development forum are due by July 16. NBN said it is looking to lodge the variation with the ACCC in the final quarter of 2021.

“We believe the pricing options presented for discussion represent a balanced approach to meeting the objectives set out in this paper. The various pricing options include ones designed to reduce retailers’ commercial risk of exposure to higher than expected usage growth; support the continuation of cheaper data capped retail plans and promote a competitive environment that enables retailers to differentiate their respective offerings from their peers,” NBN executive general manager of commercial Ken Walliss said.

“In evaluating a final pricing option, key considerations for NBN Co will be promoting strong outcomes for customers throughout Australia, creating the environment for robust retail competition and opportunities to support all customer groups as much as possible, and maintaining the company’s ability to earn a reasonable return on its investment to enable continued efficient investment in the network.”