Consumers value their personal data including the one collected by retail stores, service providers and loyalty schemes. The University of Bristol-led research, published in PLOS ONE, found 96% of people would protect their personal data from being shared by retailers and online services for commercial gain if they had a choice.

Researchers wanted to find out how much value members of the public place on keeping their personal data private by examining their willingness for it to be shared via the different types of organizations that collect data or whether they would pay to protect it from being shared.

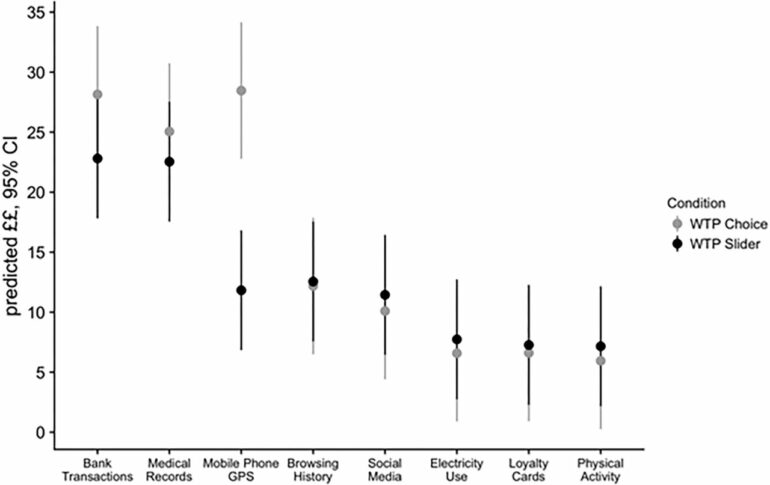

A total of 265 participants completed a 30-min online hypothetical task that asked consumers whether they would be happy to pay to keep their data private at the example of several different data types, and if so, how much they were willing to pay to protect it. Data sharing types included: electricity consumption, medical records, mobile phone GPS data, social media, online browsing history, banking transactions, physical activity, and loyalty cards.

Results showed that overall 96% of individuals were willing to pay to avoid sharing their personal data in at least one of the data sharing environments. Banking transactions was the data type people considered the most important to protect, with over 95% of people keeping their banking data private.

This was followed by medical records data with at least 79% people willing to pay to protect, followed by 72% for mobile phone GPS, 43% for online browsing history and 39.8% to protect social media data. Data collected via loyalty cards, electricity use, and physical activity was seen as less valuable as fewer participants were willing to pay to protect it.

The researchers emphasize they are not advocating for a market for personal data in which service users are forced to pay for online privacy but to highlight how much value consumers place on the privacy of their data.

Dr. Anya Skatova, Turing and UKRI Future Leaders Fellow at Bristol Medical School, said, “Digital technology opens up a new era in personal data sharing of consumer behavior and habits.”

“Most of us pay our pay our bills and do our banking online, and interact with friends online. All these interactions leave a trail of data as we go about our daily business. While it is often promised that this data is secure, it can used by undisclosed third parties which doesn’t always benefit the consumer whose data is being used.”

“Although some data can be used to improve the service we receive, it is often used to sell us more things. While almost all of us carry out digital transactions, few of us have got to grips with what it actually means to let our data out of our sight.”

“Our results from this research show how high a value people put on the privacy of their data, especially where there is no personal benefit to them.”

More information:

Anya Skatova et al, Unpacking privacy: Valuation of personal data protection, PLOS ONE (2023). DOI: 10.1371/journal.pone.0284581

Provided by

University of Bristol

Citation:

Majority of consumers care what kind of data they share with retailers and service providers, new study finds (2023, May 31)