Hewlett Packard Enterprise’s head of its GreenLake as-a-service platform, Keith White, this afternoon said Wells Fargo is the latest company to sign up for the platform, and the biggest win to date for the software offering.

GreenLake provides a number of capabilities to run either public cloud or on-premise assets in a cloud computing fashion, including machine learning operations and also simple rack-based server and storage management.

Wells Fargo, said White, selected HPE “as foundation for important digital transformation work,” work that includes building a “unified data repository.” The project, said White, includes collaboration with software maker Splunk. Wells Fargo is embracing Kubernetes and containers, noted White.

GreenLake, which was celebrated during today’s event with a movie containing sweeping images of beautiful vista — lakes, fiords, forests, lots of green things — is the centerpiece of CEO Antonio Neri’s goal of pivoting the company to “an as-a-service company.”

GreenLake takes many software and hardware offerings from HPE, and combines it with HPE financing, to produce a bundle of capabilities that can paid for on a consumption basis, as a managed service.

“This is our largest deal so far,” said Neri of Wells Fargo, following White’s presentation.

To indicate the progress in that direction, HPE’s CFO, Tarek Robbiati, noted that HPE’s as-a-service revenue is expected to rise from $900 million in revenue this year to $2.1 billion in 2023, a compounded annual growth rate of roughy 35%.

Moreover, Robbiati reiterated a projection for the annualized recurring revenue, or ARR, component of that as-a-service revenue, to rise faster than the total, by 30% to 40%, consistent with a forecast offered last year.

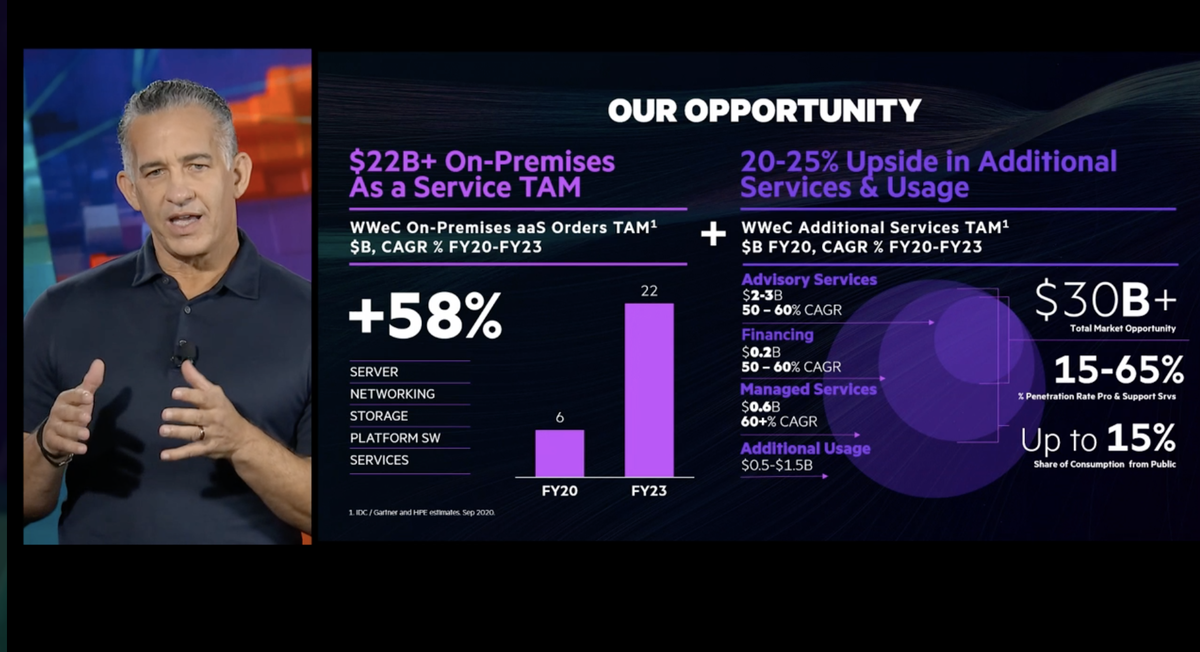

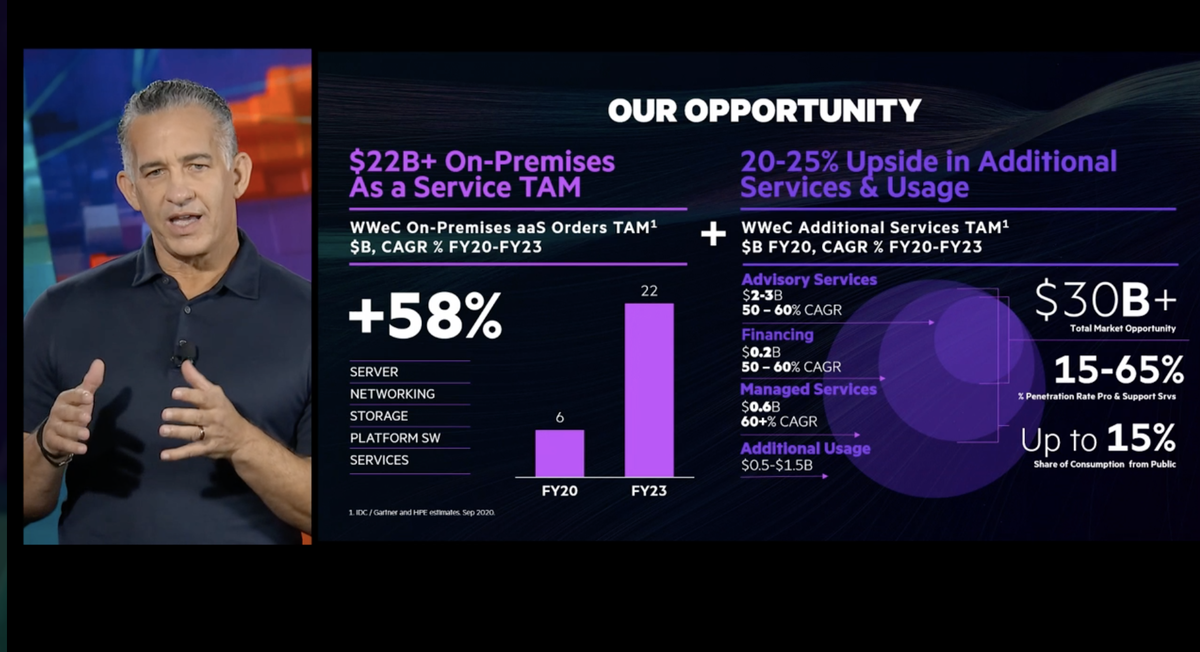

Within as-a-service, HPE plays in many areas. The specific area of on-premise, as-a-service technology that GreenLake addresses is a market worth $22 billion annually, according to IDC, Gartner, and HPE estimates, and is project to grow at a compounded annual rate of 58% over the next several years.

Higher-margin offerings such as as-a-service are also expected to help improve profitability. Robbiati forecast this afternoon that HPE will deliver non-GAAP profit next financial year ahead of what Wall Street has been modeling, while meeting revenue expectations.

HPE’s head of its GreenLake platform said Wells Fargo will be using the technology for a large digital transformation project.