Intel raised its 2021 outlook as PC demand boosted its client computing group sales and Internet of things, enterprise and Mobileye showed strong growth.

The semiconductor giant reported second quarter net income of $5.1 billion, or $1.24 a share, on revenue of $19.6 billion. Intel reported non-GAAP second quarter earnings of $1.28 a share on non-GAAP revenue of $18.5 billion.

Wall Street was expecting Intel to report second quarter revenue of $17.8 billion with non-GAAP earnings of $1.06 a share.

For 2021, Intel is projecting GAAP revenue of $77.6 billion and non-GAAP revenue of $73.5 billion with non-GAAP earnings of $4.80 a share. For the third quarter, Intel is projecting revenue of $18.2 billion with earnings of $1.10 a share. Both projections are non-GAAP and ahead of expectations.

CEO Pat Gelsinger said the semiconductor industry is surging due to the “digitization of everything.” Gelsinger added that the industry has a decade of sustained growth ahead.

On a conference call, Gelsinger said:

As compute is becoming more ubiquitous, we’re seeing sustained strength in client demand. The ecosystem is back to shipping over 1 million PC units a day despite grappling with component shortages. I expect PC TAM growth will continue in 2022 and beyond, driven by 3 factors: first, PC density or PCs per household is increasing as COVID has irreversibly changed the way we work, learn, connect and care for each other. For example, even as we emerge from COVID, we’re seeing many companies opt for hybrid work models versus full return to the office. Second, replacement cycles are shortening on a larger and aging installed base. The shift to notebooks, the deployment of new operating systems and new better experiences, such as our Evo platform, will continue to drive refresh on the 400 million PCs over 4 years old that are running Windows 10.

Second quarter events for Intel include:

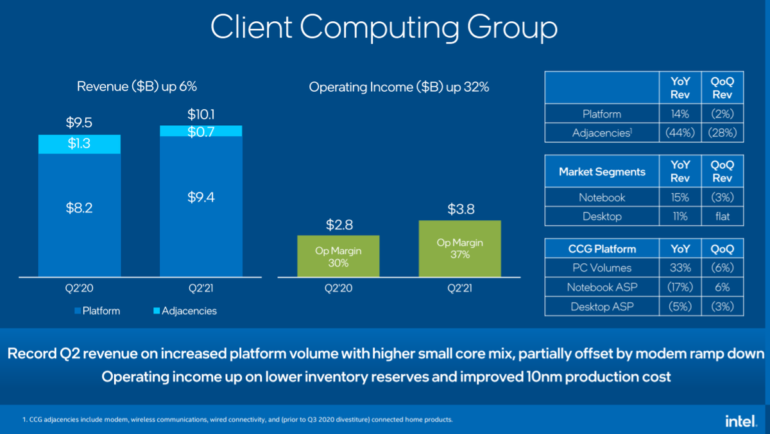

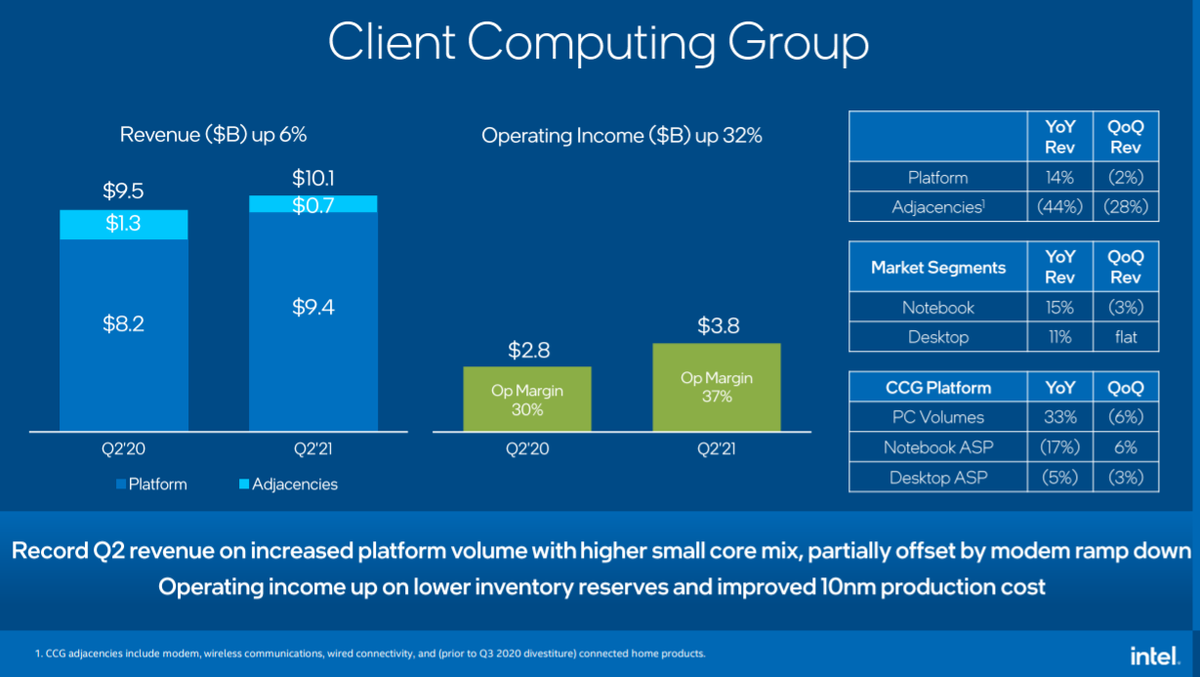

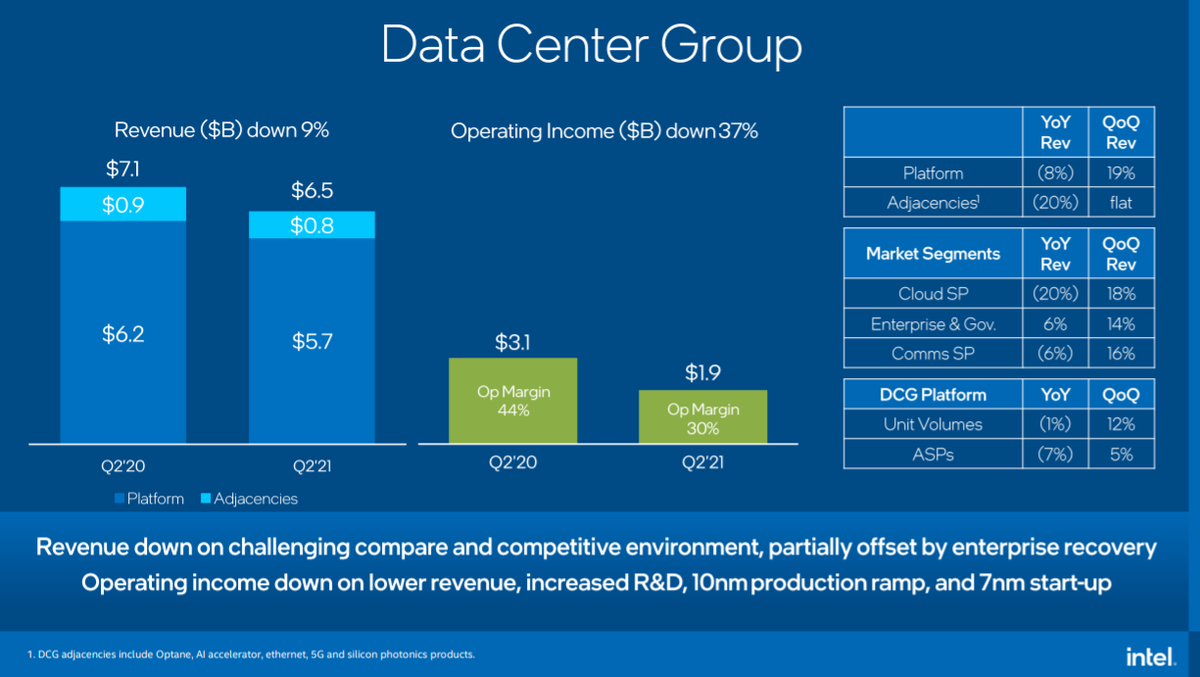

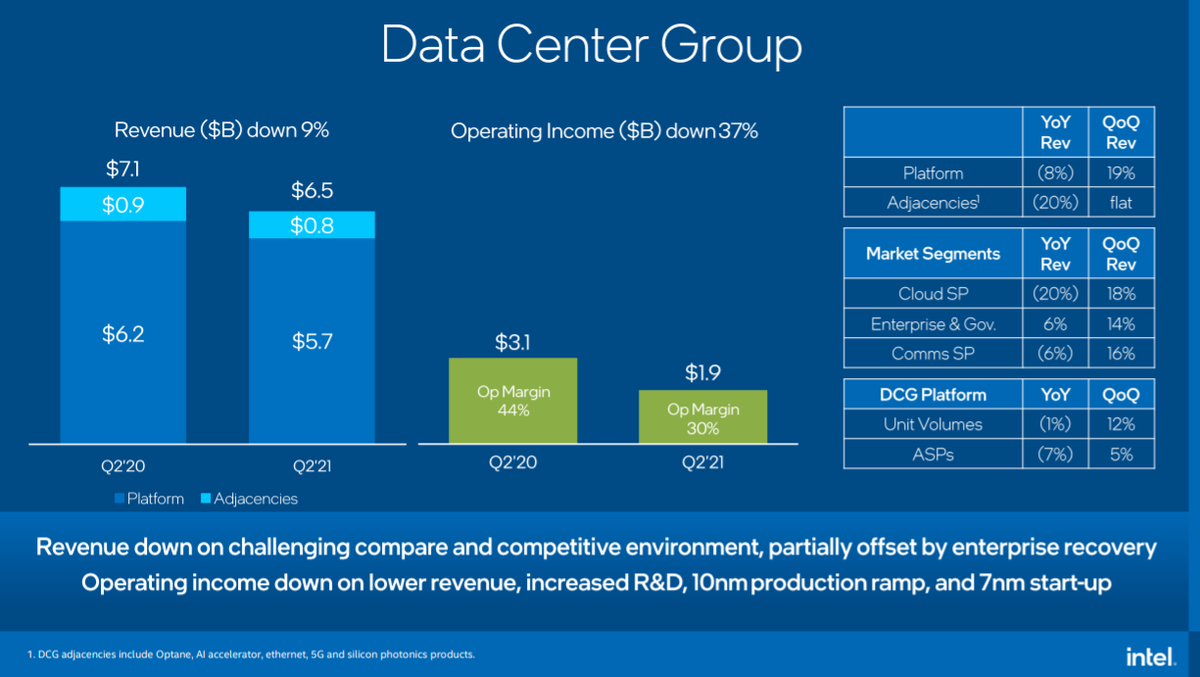

In the second quarter, Intel said its PC platform volumes were up 33% from a year ago. Intel saw strong gains in notebook and desktop processors. In the data center group, Intel saw strength in enterprise and government demand.

Gelsinger said demand for semiconductors is surging in the data center and cloud due to AI applications as well as data demand. He also talked up Intel’s efforts to expand its foundry business.

In the second quarter, we continued to see Intel Foundry Services build momentum. We are now engaged with more than 100 potential customers on the basis of our 3 key value propositions. First, IFS will have the widest offering of IP ranging from x86 to ARM to RISC-V, which allows our customers the flexibility to design products using our IP catalog as well as their own. Second, we will offer our customers comprehensive access to a range of mature and leading-edge process and packaging capabilities. I am pleased to announce we recently signed our first major cloud customer to use IFS packaging solutions.

Intel has also outlined plans to boost its manufacturing in the US with a $3.5 billion investment in its New Mexico operations.