Networking equipment from Cisco Systems, Arista Networks, and Juniper Networks and others runs on operating system software owned and built by those vendors. Some parties think that needs to change.

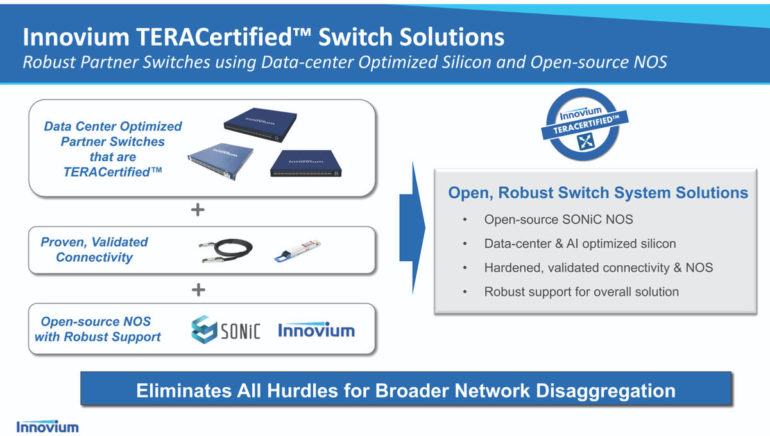

Tuesday morning, Innovium, a vendor to Cisco and others of switching chips, announced it with partners in the original device maker, or ODM, field, it is testing and certifying network switches built on its chips and the open-source SONiC operating systems, a network operating system developed by Microsoft and the Open Compute Project and licensed under a mix of the GNU GPL and the Apache License.

“These big cloud companies are going down the path of disaggregated switching, and we wanted to bring that to the smaller customers,” said Amit Sanyal, who is the head of marketing for Innovium, in a phone call with ZDNet.

Innovium sells a family of switch chips called Teralynx that scale from system throughput of 1 terabit per second on up to 25.6 terabits. The company competes with Broadcom, which sells the vast majority of chips that power networking switches from Cisco Systems and others.

As Senyal describes the problem, networking is going the route of purpose-built white box servers that Facebook and other cloud giants have used. “Hyper-scalers pick the right chip, the right server, the OS, and then management and orchestration tools,” he said.

“They can get faster innovation, they can scale the infrastructure very quickly and easily, and the same thing is happening in networking.”

The immediate pay-off is a big cut to both capital expenditures and operating expenditures. Using an open-source switch can reduce capex by 50% and reduce opex by 30%, according to data from Gartner cited by Sanyal. The combined total cost of ownership is claimed to be a two-times advantage relative to Cisco and other switches.

Also: Network chip contender Innovium scores $170 million to challenge Broadcom, prepares for the 400-gig onslaught

However, the software support has not been there to allow a broad market of white-box suppliers as exists in the Windows or Linux server market.

“The customers didn’t have the resources of the hyper -scalers to put all this together,” said Sanyal. “They rely on OEMs, and the OEMs rely on their proprietary NOS [network operating systems],” he said, referring to Cisco and Arista and others.

SONiC has been in development for four years, and Innovium has been investing in the software to “harden it,” he said, to validate its operation on hardware from numerous ODMs, and test its use with a variety of connectivity, including optics of various sorts and cabling.

The target are smaller cloud operators who don’t have an “army of engineers” the way Facebook and Microsoft do, he said. That means Innovium and its ODM partners can provide a “single throat to choke” when a SONiC-based switch needs technical support, he said.

Microsoft’s LinkedIn business is using the Innovium-based switches with SONiC in production in multiple data centers in Texas and Oregon, said Sanyal. And there is interest from Tier-2 cloud providers, he said.

Innovium, based in San Jose, has received $380 million in venture capital, and is currently valued at $1.3 billion, said Sanyal.

Innovium claims to have 29% of the market as represented by total worldwide shipments of fifty-gigabit-per-second “SERDES,” or serializer-deserializers, a common measure of ports shipped on a high-end network switch.

That compares to 70% for Broadcom and just 1% for all other network switch silicon vendors. That means that Innovium has gained market share since ZDNet spoke with the company last July. At that time, Innovium had only 23% of the market to Broadcom’s 76%.

Open-source network operating systems can be a threat, conceivably, to the differentiation and lock-in of the operating systems sold by Cisco, Arista, and Juniper, the iOS, EOS, and JunOS, respectively.

Asked about those vendors, who also are customers of Innovium, Sanyal told ZDNet that Innovium “will continue to work with our system partners,” and that the networking giants “could leverage this to cut back on their R&D, to focus on value-added services on top of the NOS.”

However, the writing is on the wall, and Sanyal suggested OEMs have to realize the growing popularity of SONiC.

“All the vendors have to listen to what the customers and the trends are saying, and they will have to adapt to meet the customers’ needs.” A blog post cited by Sanyal, written by Gartner’s Andrew Lerner this month, projects that by 2025, 40% of organizations that run “large data center networks,” meaning, more than 200 switches full, will run SONiC in production.

Data from the 650 Group claims users of SONiC, including Microsoft Azure, Baidu, and T-Mobile, have deployed over 3.8 million ports on SONiC.

Already, networkers have made gestures of support for SONiC. For example, Arista last year said that in partnership with Microsoft, it adjusted its switches to provide its customers with “the flexibility to deploy SONiC software on Arista switching platforms, combining the benefits of open source software with Arista EOS®for open, high performance, highly available networks.”