Medium- and heavy-duty vehicles (MHDVs) account for just 5% of vehicles on the road in the United States, yet they are responsible for 21% of transportation-related greenhouse gas emissions. Reducing MHDV emissions is vital to mitigating the effects of climate change and improving air quality. Zero-emission vehicles (ZEVs)—such as battery electric vehicles (EVs) and hydrogen fuel cell electric vehicles (FCEVs)—offer a solution.

While projecting future technology adoption is complex and many factors influence consumer decisions, economics play a key role in choosing technologies for commercial vehicle applications. A recent study by the National Renewable Energy Laboratory (NREL) explored how the total cost of driving for zero-emission and diesel MHDVs could evolve over time under different scenarios, from the present day to 2050.

“With continued improvements in vehicles and fuels, ZEVs are rapidly becoming commercially viable, potentially reaching total cost of driving parity or better compared to diesel vehicles by 2035 in all market segments,” said NREL’s Catherine Ledna, a decision support analyst who led the study.

A full transition to ZEV sales by 2035 would result in a 65% reduction in emissions by 2050 compared to 2019. Incentives such as the zero-emission MHDV purchase tax credits made possible via the 2022 Inflation Reduction Act (IRA) further accelerate total cost of driving competitiveness and spur emissions reductions up to 70%.

The results of NREL’s study are detailed in a recent iScience journal article—”Assessing Total Cost of Driving Competitiveness of Zero-Emission Trucks”—by Ledna and NREL’s Matteo Muratori, Arthur Yip, Paige Jadun, and Christopher Hoehne as well as Kara Podkaminer from the U.S. Department of Energy.

Paving the way for zero-emission MHDVs

The path to zero-emission MHDVs is supported by various proposed and existing actions, including policies ranging from increased air quality and greenhouse gas emissions standards to tax credits for ZEV purchases as well as investments in research and development for ZEV technologies and infrastructure deployments.

For example, the IRA includes tax credits of up to $40,000 for qualifying clean vehicle purchases, including EVs and FCEVs, as well as incentives for charging and refueling infrastructure. More recently, the U.S. Environmental Protection Agency has proposed more stringent greenhouse gas emission rules for model years 2027 to 2032 MHDVs.

TEMPO: The right modeling tool for the job

At the heart of the study was NREL’s Transportation Energy & Mobility Pathway Options (TEMPOTM) Model, the laboratory’s flagship sector-wide transportation energy systems model. The research team used TEMPO to estimate how the total cost of driving of MHDVs could evolve under a range of scenarios comprising technology cost and progress, fuel costs, and policies, while also considering new vehicle purchases, stock turnover, vehicle activity, energy consumption, and greenhouse gas emissions.

“While recent studies have evaluated the economic competitiveness and technical feasibility of zero-emission MHDVs in one or more specific market segments, our study was unique in its consideration of total cost of driving competitiveness, adoption, energy consumption, and fleet turnover across all MHDV applications,” Ledna added.

NREL’s analysis captured differences in vehicle use and energy consumption across diverse MHDV market segments, which have distinctive technical and economic requirements resulting in differences in the cost competitiveness of ZEV technologies. Case in point: The nation’s MHDV fleet encompasses vehicles ranging from 10,000 pounds to more than 33,000 pounds and driving distances of less than 10,000 miles per year to greater than 200,000.

Spotlight on technology progress and incentives

Today, ZEVs comprise a small share of existing MHDVs and face near-term barriers such as high purchase costs, limited charging or refueling infrastructure, and logistical challenges for fleet conversions.

“Thanks to recent technology progress and investments in clean vehicles, EVs have already become a viable solution for some use-cases,” said NREL’s Muratori, a senior transportation and energy systems engineer. “It will take some years for ZEVs to reach cost-competitiveness with diesel across all segments and applications, but we are on the right path and EV technology has progressed more rapidly than expected during the last decade.”

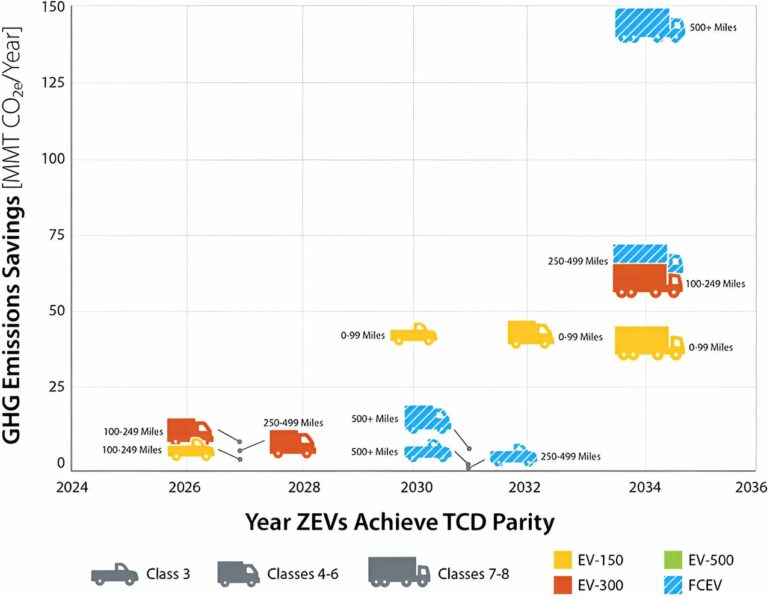

According to the NREL study, the time horizon in which ZEVs become competitive with diesel vehicles on a total cost of driving basis varies according to vehicle class and market segment. The combination of capital costs, operational costs, and vehicle miles traveled generally determines when a ZEV technology achieves parity. For all vehicle applications, at least one ZEV technology achieves parity with diesel before 2035.

This study shows that by 2032 (and in many cases before then), ZEVs achieve total cost of driving parity with diesel vehicles in light-medium (Class 3) and medium-duty (Class 4–6) trucks, driven by declines in battery costs. By 2035, shorter-range EVs with 150 to 300 miles of electric range reach parity in short-haul and regional market segments, which have lower daily vehicle miles traveled and a reduced need for larger, more expensive batteries. Heavy trucks (Classes 7–8) and trucks that drive longer distances (500-plus-mile shipment distance) achieve parity after 2030.

IRA incentives accelerate technology adoption and emissions savings

With IRA vehicle purchase tax credits, ZEVs—particularly EVs—achieve total cost of driving parity with diesel vehicles on substantially earlier time frames.

Most light-medium vehicles achieve total cost of driving parity by 2026, which could result in an additional 700,000 light-medium vehicles sold, 48 billion vehicle miles traveled by ZEVs, and carbon dioxide tailpipe emissions savings of 33 million metric tons between 2023 and 2032. Meanwhile, most medium vehicles achieve total cost of driving parity by 2023 or 2024, resulting in an additional 1.1 million vehicles sold, 81 billion vehicle miles traveled by ZEVs, and carbon dioxide tailpipe emissions savings of 73 million metric tons.

For heavy vehicles, short-haul market segments achieve parity between 2027 and 2030 (versus 2034 without incentives). Heavy regional and long-haul market segments continue to achieve parity in 2034, with FCEVs remaining the most cost competitive on a total cost of driving basis.

“IRA incentives greatly accelerate the time at which ZEVs reach total cost of driving parity, enabling market uptake in the near term,” Muratori said. “By 2050, a rapid transition to ZEVs results in substantial greenhouse gas emissions reductions—65% relative to 2019 levels without incentives and 70% with IRA vehicle purchase tax credits.”

More information:

Catherine Ledna et al, Assessing total cost of driving competitiveness of zero-emission trucks, iScience (2024). DOI: 10.1016/j.isci.2024.109385

Provided by

National Renewable Energy Laboratory

Citation:

Study examines cost competitiveness of zero-emission trucks (2024, April 4)