In August 2022, Congress passed the Inflation Reduction Act (IRA). Signed by President Joe Biden, the legislation attempted to curb inflation, lower the deficit, and invest heavily into domestic clean energy.

One aspect of the bill was setting a market value-based target for battery-critical mineral content in electric vehicles (EVs). By 2027, for an EV to be tax-credit eligible, 80 percent of the market value of critical minerals in its battery must be extracted or processed domestically or by US free-trade partners (FTPs).

While this goal is well-intended, there are reasons to believe the mandate is unreachable and could create new problems.

In a commentary published March 6 in the journal Nature Sustainability, Northwestern Engineering professor Jennifer Dunn and Ph.D. student Jenna Trost determined the 80 percent target could be achievable for some types of batteries for plug-in hybrid vehicles, but meeting demand for fully electric vehicles with batteries that meet IRA criteria would be challenging. Instead, a mass-based target could avoid some of the challenges posed by a market-value target, such as pinning down a consistent market value for each mineral when market prices are volatile.

Dunn and Trost also concluded the approach taken by the IRA discounts the environmental effects of mining, non-critical minerals supply, and definitions that avoid gamesmanship.

Below are three takeaways from their paper.

The rise of unintended consequences

To meet the demands of the bill, a steep increase in domestic mining would be needed. That could pose environmental issues, including water pollution, in addition to creating greenhouse gas emissions from burning fuel to operate mining equipment.

Building mines, Dunn said, can take up to a decade. Permitting processes to protect the environment and worker safety can create delays and extend that timeline. Communities may also resist new mines because of the potential environmental impact. Establishing a domestic supply of minerals is unlikely to meet the IRA’s aggressive timeline.

“There’s a lot of interesting social and political dynamics. Some people don’t want new or expanded mines, and others welcome the economic activity and the opportunity to become more energy independent by building out a domestic minerals supply chain,” said Dunn, associate professor of chemical and biological engineering and director of the Center for Engineering Sustainability and Resilience. “It’s fascinating to watch how this is going to play out.”

Much of the mineral supply chain will continue to be international. As a result, there’s also the issue of labor laws in countries that are not FTPs, raising the question of responsible sourcing.

One example is Argentina, a non-FTP country that provided 59 percent of the 2,618 tons of lithium mineral the US imported in 2019. Argentina does not offer the labor and environmental protections the US requires of FTP partners, but any minerals acquired from the country would still count if they were processed domestically. Dunn and Trost argue that guidance should be provided regarding what constitutes processing, and what are allowable sources for the minerals that would be processed in the US or an ftp://ftp.

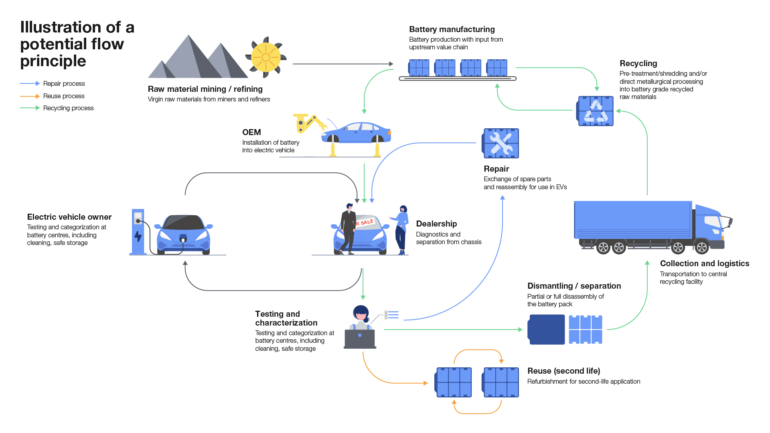

“We have ostensibly good labor protections for miners, but that’s not the case everywhere. What are the ethical implications of using minerals from other places?” Dunn said. “And then, are we going to be really serious about recycling, because we’re clearly not with plastics? We have to be really serious. Investment in battery recycling is growing, but it still needs to be larger.”

Trost brought up another point.

“In addition to the environmental issues, there are social issues to consider, like migration and loss of livelihood,” Trost said. “Mining might cause people to move off their land and strip them of their homes, livelihoods, and culture. It’s a multi-faceted problem that’s really interesting and really pressing.”

Why mass-based would be better than market-based

Dunn and Trost raised four concerns about the use of a market value-based target:

A market value-based target can be met before all the critical minerals in a battery are acquired from a secure source such as the US or an FTP, depending on the battery chemistry.The environmental effects of critical minerals acquisition are physically tied to the amount of mineral produced rather than its market value.Market values fluctuate. Dunn and Trost note that prices for cobalt and nickel, for example, have increased by about $13,000 and $4,000 per metric ton, respectively, since 2019.Many non-critical minerals central to batteries are mainly produced outside the US, raising supply risks.

Instead, the authors suggested using a mass-based standard. Using a mass-based target, they wrote, would reduce uncertainty and hold all automakers to the same standard in the interpretation of market value.

“Given the fluctuations in mineral market values, using a mass-based target in the policy could improve its transparency but may not incentivize production of high-value minerals domestically, which is important for mineral security,” Dunn and Trost wrote.

Deliberation is good

When it was passed last summer, the IRA was meant to address crushing inflation and deliver a political win for the Biden administration. As for some of the environmental concerns, Dunn and Trost think a slower process would have allowed some of the finer points of the bill to be more fully developed.

“It’s hard to design policy well in a hurry that holistically considers the social and environmental effects of the minerals supply chain,” Dunn said. “It’s important to leverage the potential of electric vehicles to reduce emissions from cars, but when we design policies to encourage their use, we need to take a holistic view that helps us get off on the right foot with establishing a low-environmental impact, safe, and ethical mineral supply chain.”

To stress that holistic view, Dunn is leading a Global Engineering Trek for undergraduates next fall to Santiago, Chile. Chile is one of the world’s top two lithium suppliers, and Dunn wants students to learn about the extraction process and understand the costs and benefits of mining.

“We want Northwestern students to understand this is a global issue. There are people on the ground in these mining communities who are experiencing the negative effects of expanded mining,” Dunn said. “As engineers, when we design materials for batteries or anything else, we need to think about where the materials are coming from. Could I use less of it? Could I use a different material? Can I design it for recycling so it’s easy to get it back? We’re thinking about this holistically. We want to give students experiences that bring home the importance of these design choices for people along the supply chain as well as the immediate technology user.”

More information:

Jenna N. Trost et al, Assessing the feasibility of the Inflation Reduction Act’s EV critical mineral targets, Nature Sustainability (2023). DOI: 10.1038/s41893-023-01079-8

Provided by

Northwestern University

Citation:

The challenges of mining for electric-vehicle batteries (2023, March 6)