Twitter reported better-than-expected first quarter earnings but fell just short on user growth numbers. The company’s guidance also fell below analyst expectations.

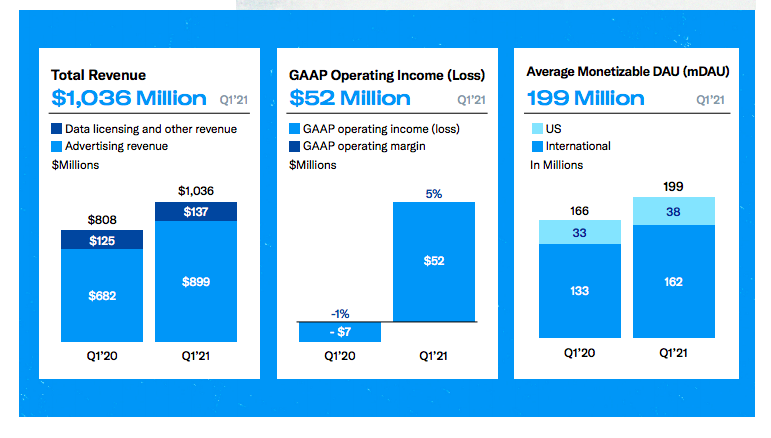

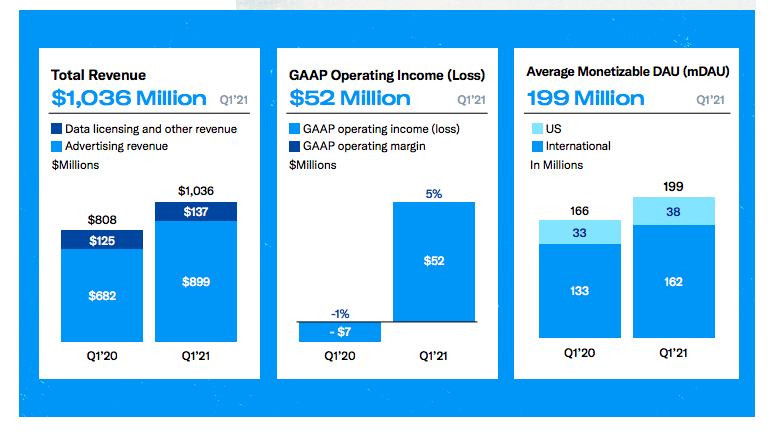

For the first quarter, Twitter reported revenue of $1.04 billion, up 28% from a year ago with data licensing sales of $137 million, up 9% from a year ago and ad revenue of $899 million. Twitter reported first quarter net income of $68 million, or 9 cents a share. Adjusted earnings were 16 cents a share.

Wall Street was expecting Twitter to report earnings of 14 cents a share on revenue of $1.03 billion.

According to Twitter, monetizable daily active users were 199 million in the first quarter, up from 166 million a year ago. Analysts were looking for Twitter to report monetizable daily active users of 200 million. Shares of Twitter fell more than 8% after hours.

For the second quarter, Twitter projected revenue between $980 million and $1.08 billion with an operating loss between $170 million and $120 million. Analysts are looking for second quarter revenue of $1.06 billion.

“Q1 was a solid start to 2021, with total revenue of $1.04 billion up 28% year-over-year, reflecting accelerating year-over-year growth in MAP revenue and brand advertising that improved throughout the quarter,” said Ned Segal, Twitter’s CFO. “Advertisers continue to benefit from updated ad formats, improved measurement, and new brand safety controls, contributing to 32% year-over-year growth in ad revenue in Q1.”