Cisco on Wednesday published third quarter financial results slightly above expectations with growth across categories. The company reported 10 percent year-over-year total product order growth, representing the strongest demand in nearly a decade.

At the same time, supply chain challenges are impacting Cisco’s expectations for this quarter’s adjusted gross margins.

“We’ve locked in both supply and pricing with some of the key component providers that we’ve got going ahead, that’s what you see built into the margin guide,” CFO Scott Herren said on a Wednesday conference call. “And I think the supply chain issues will stay with us at least through the end of this calendar year.”

CEO Chuck Robbins added,”If we come to the conclusion that any of these cost increases… are going to be more sustained, then we will look at strategic price increases where we have to. That work is already underway. There’s already some decisions that we’ve made… It’s a pretty dynamic situation.”

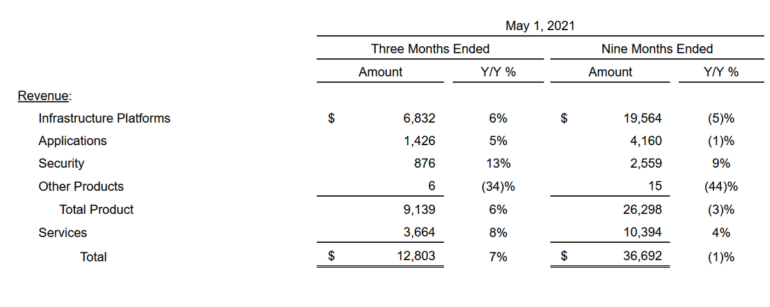

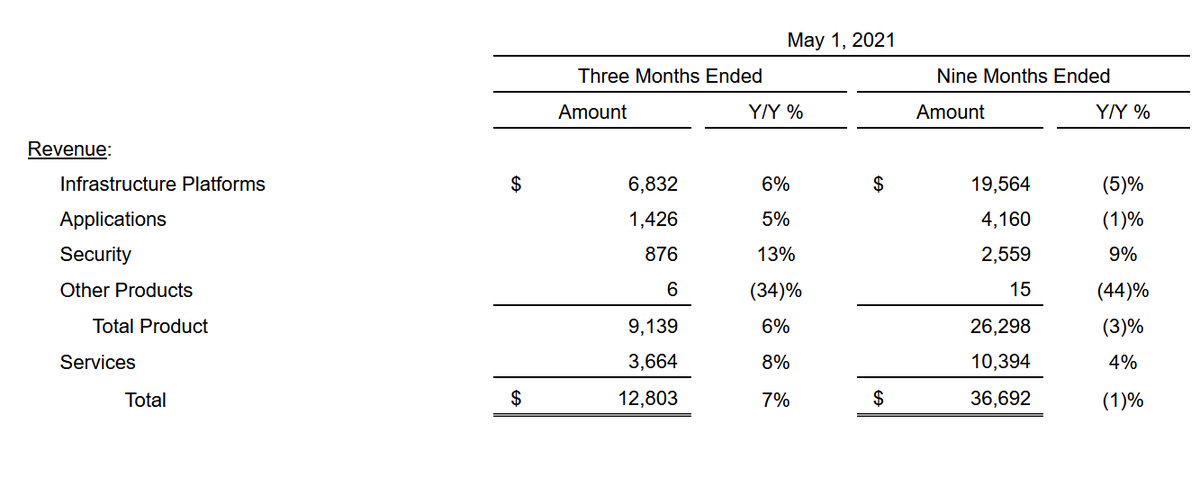

Cisco’s Q3 non-GAAP earnings per share came to 83 cents on revenue of $12.8 billion up 7 percent year-over-year.

Wall Street was expecting earnings of 82 cents per share on revenue of $12.56 billion.

Overall, product revenue was up 6 percent year-over-year, totaling $9.14 billion. Within that category, security revenue was up 13 percent to $876 million. Revenue from infrastructure platforms 6 percent to $6.8 billion, while applications revenue was up 5 percent to $1.4 billion. Revenue from “other products” declined 34 percent to $6 million.

Service revenue was up 8 percent year-over-year, reaching $3.66 billion.

“Cisco had a great quarter with strong demand across the business,” Robbins said in a statement. “We are confident in our strategy and our ability to lead the next phase of the recovery as our customers accelerate their adoption of hybrid work, digital transformation, cloud, and continued strong uptake of our subscription-based offerings.”

Deferred revenue in Q3 was $$20.9 billion, up 12 percent in total, with deferred product revenue up 20 percent. Deferred service revenue was up 7 percent.

Remaining Performance Obligations came to $28.1 billion at the end of Q3, up 10 percent.

For the fourth quarter, Cisco expects revenue growth of 6 percent to 8 percent year-over-year. It expects a non-GAAP gross margin rate of 64 percent to 65 percent and a non-GAAP operating margin rate of 32 percent to 33 percent.