SAP has reported third-quarter earnings results revealing reduced income and COVID-19’s impact on the company’s cloud business.

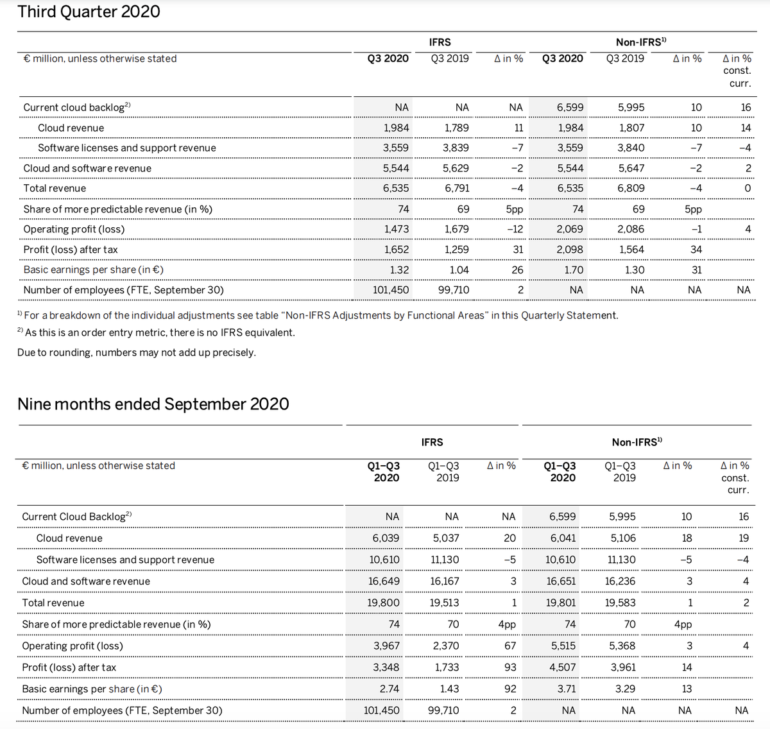

SAP’s Q3 2020 earnings (statement) (.PDF), ending September 2020, reveal revenues of €6.54 billion IFRS, down 4% year-over-year (or flat non-IFRS and at constant currencies) with basic earnings per share of €1.32 (€1.70 non-IFRS).

In Q2 2020, SAP reported €6.74 billion IFRS revenue.

SAP reported an operating profit of €1.47 billion IFRS, down 12% year-over-year and 1% to €2.07 billion non-IFRS and up 4% non-IFRS at constant currencies.

SAP says this reduction in operating profit is “primarily due to higher share-based compensation expenses compared to the prior year period.”

Operating cash flow for the first nine months of the year was €5.09 billion, up 54% year-over-year due to “lower restructuring-related payments and lower income tax payments.”

A cloud backlog of €6.6 billion has been recorded, while cloud revenue grew by 11% year-over-year, to €1.98 billion (IFRS), up 10% non-IFRS and up 14% non-IFRS at constant currencies. Software licenses revenue decreased by 23% year-over-year to €0.71 billion (IFRS and non-IFRS) and down 19% (non-IFRS at constant currencies).

Overall cloud and software revenue reduced by 2% year-over-year to €5.54 billion (IFRS) and up 2% non-IFRS at constant currencies.

SAP S/4HANA added an additional 500 customers to the roster in Q3 2020, up 20% year-over-year. SAP S/4HANA now accounts for over 15,100 customers, of which approximately 8,100 are now live.

The four main business segments SAP reports on, “Applications, Technology & Services,” “Qualtrics,” “Concur” and “Services” also felt the ongoing impact of the pandemic over the third quarter of 2020.

Applications, Technology & Services revenue decreased by 2% to €5.17 billion year-over-year.

Concur, the firm’s travel, expense, and invoice management solutions unit, reported revenue of €357 million year-over-year, down 14% — or 10% at constant currencies. Concur is considered responsible for a negative impact on cloud growth of roughly 6%.

Qualtrics revenue was €169 million, an increase of 22% year-over-year, or 28% at constant currencies.

The Services segment, including digital transformation and the Intelligence team, reported revenue of €753 million, down 16% year-over-year.

“While the vast majority of consulting projects continue to be efficiently delivered remotely and SAP’s premium services remain in high demand, in particular, SAP’s training business was also impacted due to delays in re-opening of global training centers,” the company added.

SAP’s business outlook for the full 2020 fiscal year has changed. SAP says that due to the re-introduction of lockdowns amidst a second COVID-19 wave, the company “no longer anticipates a meaningful recovery in SAP Concur business travel-related revenues for the remainder of the year.”

The tech giant has also reduced its FY2020 predictions for cloud revenue from €8.3 billion – 8.7 billion (non-IFRS at constant currencies) to €8 billion – €8.2 billion.

Cloud and software revenue has been slashed from €23.4 billion – €24 billion to €23.1 billion – €23.6 billion, and total revenue expectations have been reduced from €27.8 billion – €28.5 billion to €27.2 billion – €27.8 billion.

2020 cash flow predictions, however, have been raised to €6 billion, previously expected to be €5 billion or more.

“COVID-19 has created an inflection point for our customers,” commented SAP CEO Christian Klein. “The move to the cloud combined with a true business transformation has become a must for enterprises, to gain resiliency and position them to emerge stronger out of the crisis. Together with our customers and partners we will co-innovate and reinvent how businesses run in a digital world.”

Previous and related coverage

Have a tip? Get in touch securely via WhatsApp | Signal at +447713 025 499, or over at Keybase: charlie0