Peloton has acquired Precor in a $420 million deal that will dramatically bolster its manufacturing capacity and equipment that can be connected to its digital services.

The purchase also broadens Peloton’s reach. Peloton has been a COVID-19 darling as more people worked out at home. Now with Precor, Peloton gets more access to the commercial market, which should bounce back courtesy of COVID-19 vaccines.

In a statement, Peloton said it will continue to manufacture connected fitness products before the end of calendar 2021. Peloton plans to establish manufacturing capacity and boost research and development with Precor’s team.

Precor, formerly a division of Finnish sporting goods company Amer Sports, will be a business unit inside of Peloton with Precor President Rob Barker as CEO. Barker will report to William Lynch, president of Peloton. Precor is best known for its elliptical lineup, but its strength equipment includes models under its own brand as well as Icarian. Precor also has a set of networked fitness and connected solutions products.

Peloton has surged in 2020:

Peloton is projecting 2.17 million Connected Fitness subscriptions or more for fiscal 2021. Peloton said in its first quarter shareholder letter:

While we have significantly expanded our manufacturing capabilities and expect continued progress over the coming months with the opening of our new Shin Ji facility at Tonic, we will be operating under supply constraints for the foreseeable future.

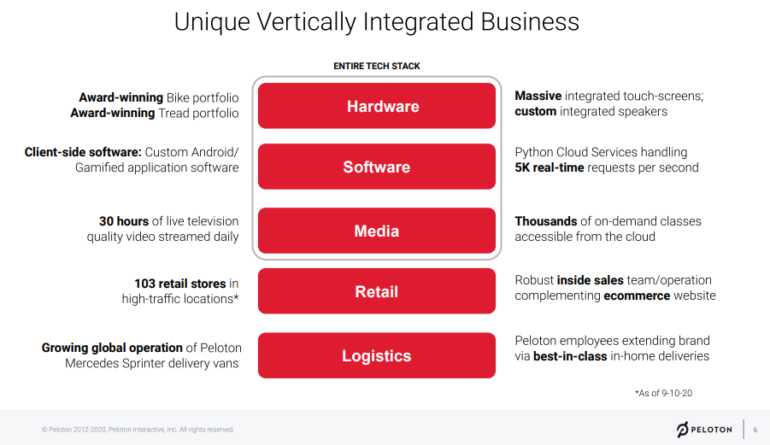

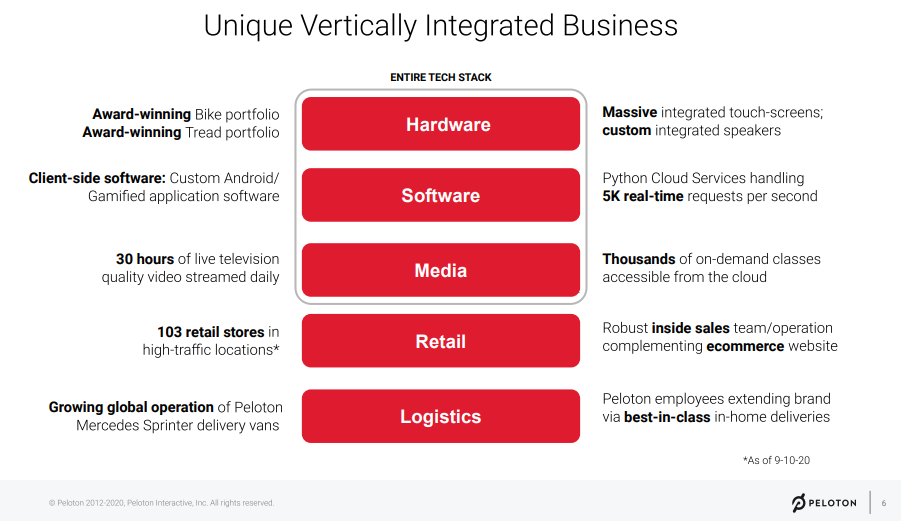

Lynch said Precor will help address those issues and bring supply chain scale to Peloton. Precor will also bring 625,000 square feet of manufacturing capacity with tooling, fabrication and quality assurance to Peloton, which has struggled to meet demand with its Taiwan facilities and third party manufacturing. Precor will immediately bolster the hardware portion of Peloton’s integrated stack.

Precor also gives Peloton a hybrid fitness play. Precor is a staple in gyms and fitness centers and Peloton’s bet is that brick-and-mortar and home workouts won’t be zero sum.

A few observations:

Peloton has broadened its equipment reach from bikes to treadmills, but Precor has ellipticals as well as strength machines. Peloton’s digital content and classes can reach more machines. Precor gives Peloton manufacturing knowhow to meet demand in the future. The commercial market, which is clearly struggling amid COVID-19 pandemic shutdowns, is getting a vote of confidence even if Peloton is using Precor as a hedge. Peloton will have a broader base for its connected fitness offerings. In the future, Peloton is likely to drive profit margins via its app over connected hardware.