As automobile electrification speeds up, the world faces an overwhelming need for critical metals and minerals to make atmosphere-saving electric vehicles possible.

The demand for battery-grade lithium, nickel, cobalt, manganese and platinum will climb steeply as nations work to reduce greenhouse gas emissions through mid-century, but will likely set off economic snags and supply-chain hitches, according to new Cornell research published April 11 in Nature Communications.

“Electrification and decarbonizing fuel production are critical for adequately mitigating greenhouse gas emissions from road transportation,” said Fengqi You, the Roxanne E. and Michael J. Zak Professor in Energy Systems Engineering, the senior author on “Trade-off Between Critical Metal Requirement and Transportation Decarbonization in Automotive Electrification.”

“Improving the efficiency of internal combustion engine vehicles can cut greenhouse gas emissions,” You said, “but deep decarbonization for the road transportation sector requires electrification and a shift to cleaner energy, such as electricity generated from renewable sources.”

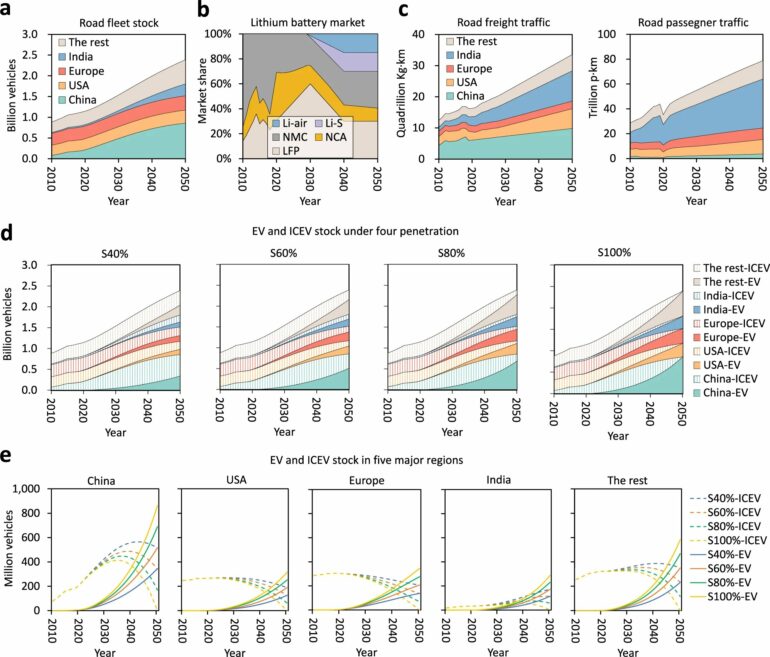

In the new paper, You and his colleagues examined 48 major countries that are committed to playing a strong role in electrifying transportation, including the U.S., China and India.

“Monotonic growth in global demand for critical metals to 2050 is the most prevalent trend,” You said. “It’s mainly driven by the electric vehicle market penetration and battery technology development.”

If achieving a scenario where 40% of vehicles are electric by 2050, the need for lithium globally will increase 2,909% from the 2020 level. If 100% of vehicles are electric by 2050, the need for lithium more than doubles, to 7,513%.

From the years 2010 to 2050, in a scenario where all vehicles are electric, the annual demand for lithium globally increases from 747 metric tons to 2.2 million metric tons.

By mid-century, for example, the demand for nickel eclipses other critical metals, as the global need ranges from 2 million metric tons, where 40% of vehicles are electric, to 5.2 million metric tons where all vehicles are electric.

The annual demand for cobalt (ranging from 0.3 to 0.8 million metric tons) and manganese (ranging from 0.2 to 0.5 million metric tons) will rise by the same order of magnitude in 2050, according to the paper.

Currently, critical metals and minerals are centralized in politically unstable Chile, Congo, Indonesia, Brazil, Argentina and South Africa, according to the World Bank.

“The unstable supplies of critical metals and minerals can exacerbate supply risks under surging demand,” You said.

In the paper, the researchers note caution on the electrification of heavy-duty vehicles, which require more critical metals than other vehicles. Although they account for only between 4% and 11% of the total road fleet in some countries, battery-related critical metals used in heavy-duty electric vehicles will account for 62% of the critical metal demand in the decades ahead.

Among the researchers’ suggestions for managing this demand:

Constructing a circular economy would be indispensable to the critical metals if it achieved a closed-loop supply chain in the future. Strategies should be considered to promote the recycling efficiency and recovery rate of end-of-life batteries at a proper pace.Countries should adopt policies that prioritize alternative designs for cathodes/anodes and fuel-cell (green hydrogen) systems to reduce the reliance on primary critical metals.Decarbonization targets for road transportation should be coupled with electric vehicle deployment, the timing of carbon peak and neutrality, and accurate emission budgets.

More information:

Chunbo Zhang et al, Trade-off between critical metal requirement and transportation decarbonization in automotive electrification, Nature Communications (2023). DOI: 10.1038/s41467-023-37373-4

Provided by

Cornell University

Citation:

Critical metal needs rise while cars, trucks decarbonize (2023, April 11)