Apple’s MacBook lineup with M1 is delivering record fiscal second quarter sales as the company crushed expectations with 54% revenue growth.

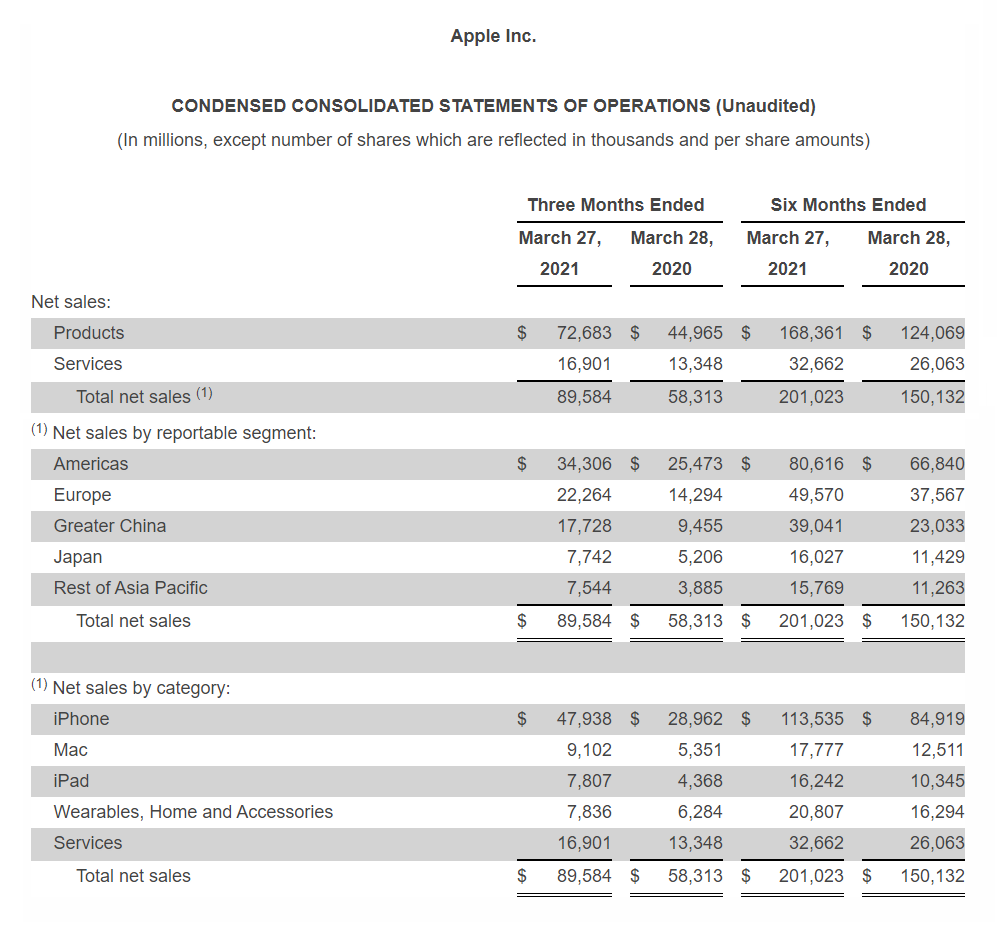

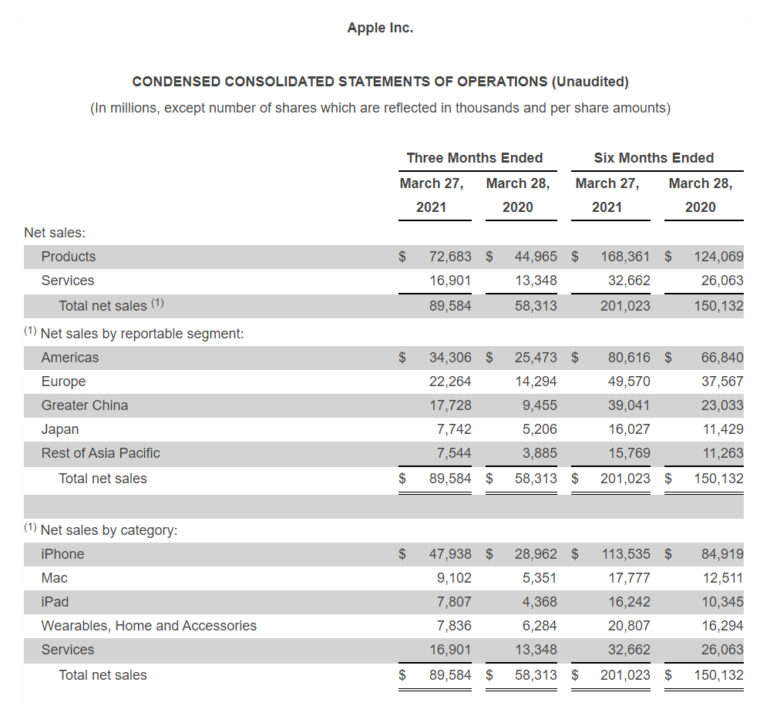

The company’s iPhone, iPad and Mac lineups are producing strong growth. The company reported second quarter earnings of $1.40 a share on revenue of $89.6 billion, up 54% from a year ago.

International sales are 67% of Apple’s total revenue.

Analysts modeled Apple delivering second quarter sales of $77.35 billion with non-GAAP earnings of 99 cents a share.

CEO Tim Cook said the company “is in a period of sweeping innovation across our product lineup.” Apple recently launched its new iMac and iPad Pro with M1 silicon.

Apple’s second quarter comparisons were relatively easy given that they lapped COVID-19 shutdowns a year ago. Apple saw strong growth in each of its regions.

iPhone second quarter revenue was $47.94 billion, up from $28.96 billion a year ago. iPad sales were $7.8 billion, up from $4.37 billion a year ago. Mac sales were $9.1 billion, up from $5.35 billion a year ago.

Wearables led by Apple Watch delivered sales of $7.84 billion, up from $6.28 billion. Services sales were $16.9 billion, up from $13.35 billion a year ago. Regarding services, Apple CFO Luca Maestri said the company now has 660 million subscriptions across its platform.

Apple also said it is raising its dividend 7% and plans to increase payouts annually going forward.

As for the outlook, Maestri didn’t provide revenue guidance, but did say supply constraints will hurt sales in the June quarter. Maestri said:

Given the continued uncertainty around the world in the near term, we are not providing revenue guidance, but we are sharing some directional insights assuming that the COVID-related impacts to our business do not worsen from what we are seeing today for the current quarter. We expect our June quarter revenue to grow strong double digits year-over-year. However, we believe that the sequential revenue decline from the March quarter to the June quarter will be greater than in prior years for 2 reasons. First, keep in mind that due to the later launch timing and strong demand, iPhone only achieved supply-demand balance during the March quarter. This will cause a steeper sequential decline than usual. Second, We believe supply constraints will have a revenue impact of $3 billion to $4 billion in the June quarter. We expect gross margin to be between 41.5% and 42.5%. We expect OpEx to be between $11.1 billion and $11.3 billion.

On an earnings conference call, Cook said:

“We saw a very strong performance for iPhone, which grew 66% year-over-year driven by the strong popularity of the iPhone 12 family. This family of devices is popular with both upgraders and new customers alike.””Over the past year, tens of millions of iPads and Macs have been deployed to help students learn, creators create. and to enhance remote work in all of its forms. This has helped iPad grow very strong double digits to its highest March quarter revenue in nearly a decade. On Mac, fueled by the M1, we set an all-time revenue record continuing the momentum for the product category. In fact, the last 3 quarters for Mac have been its 3 best quarters ever.””We continue to deploy industry-leading new tools to protect users’ fundamental right to privacy. In addition to the App Store privacy nutrition labels that we discussed on last quarter’s call, we’re proud to have launched the full implementation of App Tracking Transparency. This powerful yet simple idea gives users a choice over how their data is used and shared across the apps that they love and use every day.”