A new analysis by University of Wyoming researchers examines the impact of current federal economic incentives on large-scale, blue hydrogen production technologies and estimates the expected outcomes in long-term expenses as those hydrogen production pathways evolve.

The research, titled “Technological Evolution of Large-Scale Blue Hydrogen Production Toward the U.S. Hydrogen Energy Earthshot,” was led by Haibo Zhai, the Roy and Caryl Cline Distinguished Chair in Engineering and a professor in the UW College of Engineering and Physical Sciences. The study appears in the journal Nature Communications.

Wanying Wu, Zhai’s UW Ph.D. student, was lead author.

Launched in 2021, the U.S. Department of Energy’s (DOE) Energy Earthshots Initiative aims to accelerate breakthroughs of more abundant, affordable and reliable clean energy solutions within the decade by reducing the cost of clean hydrogen production and deployment. The ambitious goal of the program is to reduce production costs of hydrogen by 80% to $1 per kilogram of hydrogen in a decade.

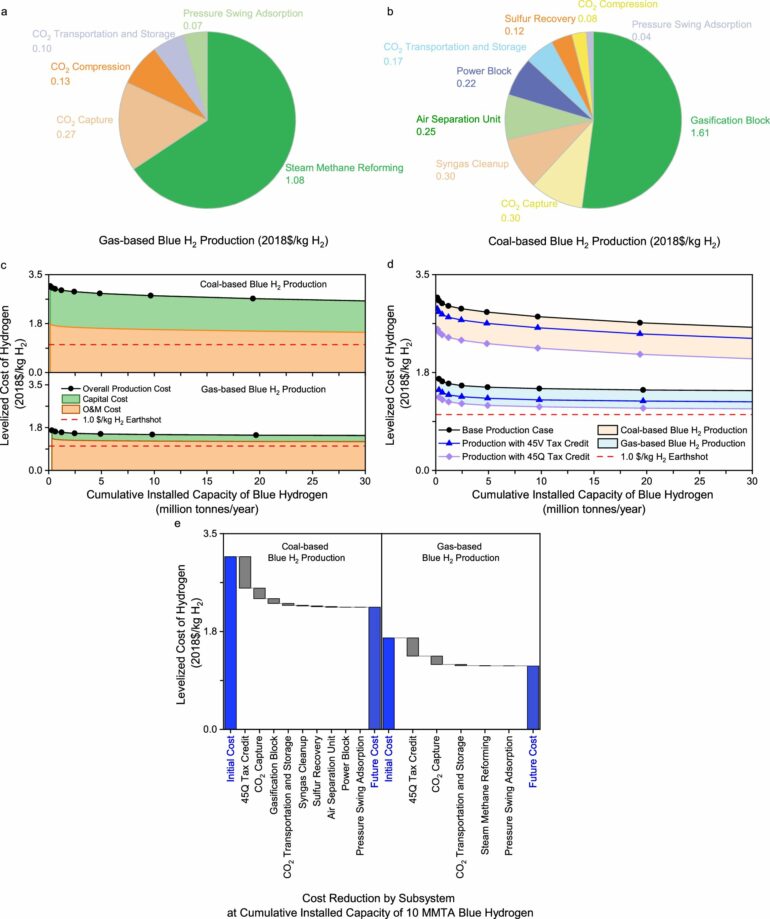

The new UW study estimates the economic benefits from learning experience by deploying large-scale blue hydrogen projects; evaluates both the 45Q tax credit for carbon sequestration and 45V tax credit for clean hydrogen production; and compares the credits’ economic role in promoting blue hydrogen production toward the Hydrogen Energy Earthshots Initiative.

“Currently, the cost of hydrogen is high, especially when produced from renewables,” Zhai says. “However, blue hydrogen—that is, hydrogen produced using fossil fuels and paired with carbon sequestration—has the potential to significantly reduce the costs of production, substantially lower emissions and support new economic opportunities in line with the goals of the Energy Earthshots Initiative so long as the tax incentives and infrastructure funding remain available to technology developers. This study is an important snapshot of where we are and where we could be in the future while building out clean hydrogen systems.”

The premise is that the more prevalent and advanced (or “experienced”) large-scale blue hydrogen systems become, the more efficient and affordable they will become. However, that is only one piece of the puzzle, Zhai says.

“We apply experience curves to estimate the evolving costs of blue hydrogen production and to further examine the economic effect on technological evolution of the Inflation Reduction Act’s tax credits for carbon sequestration and clean hydrogen,” he explains.

“We concluded in our models that the break-even cumulative production capacity required for gas-based blue hydrogen to reach DOE’s $1/kg H2 target is highly dependent on tax credits, natural gas prices, inflation rates, carbon capture uncertainties and learning rates.”

Despite these uncertainties, the study concludes that experience from the deployment of blue hydrogen projects will be helpful in lowering future costs of hydrogen production and will remain cost competitive. Additionally, paired with extended tax incentives for carbon sequestration, costs could be significantly reduced further.

More information:

Wanying Wu et al, Technological evolution of large-scale blue hydrogen production toward the U.S. Hydrogen Energy Earthshot, Nature Communications (2024). DOI: 10.1038/s41467-024-50090-w

Provided by

University of Wyoming

Citation:

Study evaluates tax credits’ role in blue hydrogen production costs (2024, July 9)