Zoom is seeing a tale of two demand curves in its customer base.

Zoom Video Communications had a strong second quarter but is going to have a tougher time showing the growth it had a year ago. The short version: Zoom’s online direct sales will be volatile as smaller customers normalize spending as large enterprises spend more on the Zoom platform.

It’s somewhat comical that Zoom’s most recent quarterly results were called mixed by many analysts given that its quarterly sales topped $1 billion for the first time. Zoom’s outlook for third quarter revenue of $1.015 billion to $1.02 billion, or 31% growth from a year ago, is solid, but shows signs of normalization. In other words, Zoom’s growth is going to slow throughout fiscal 2022 due to tough comparisons with a year ago.

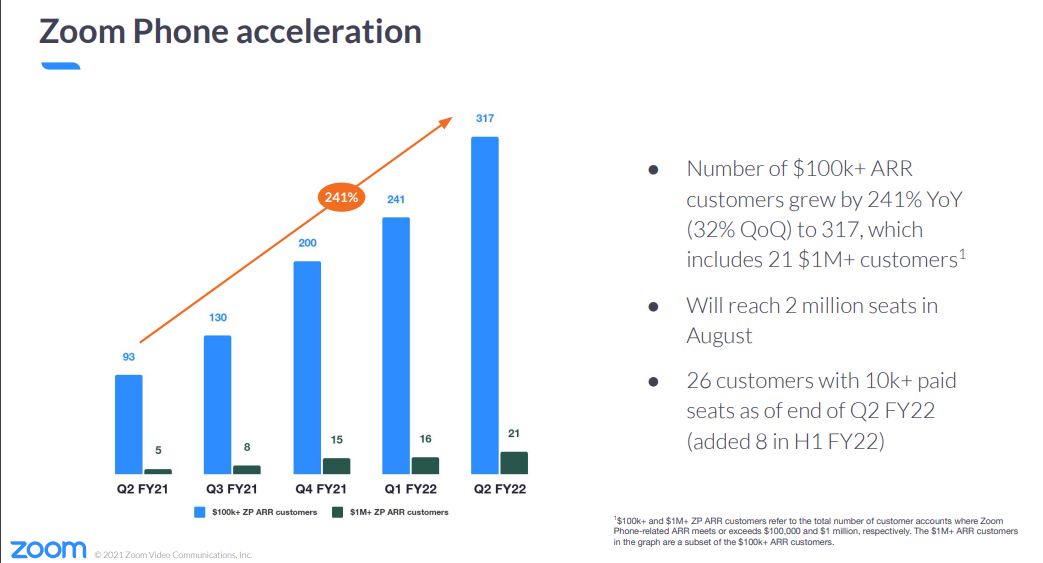

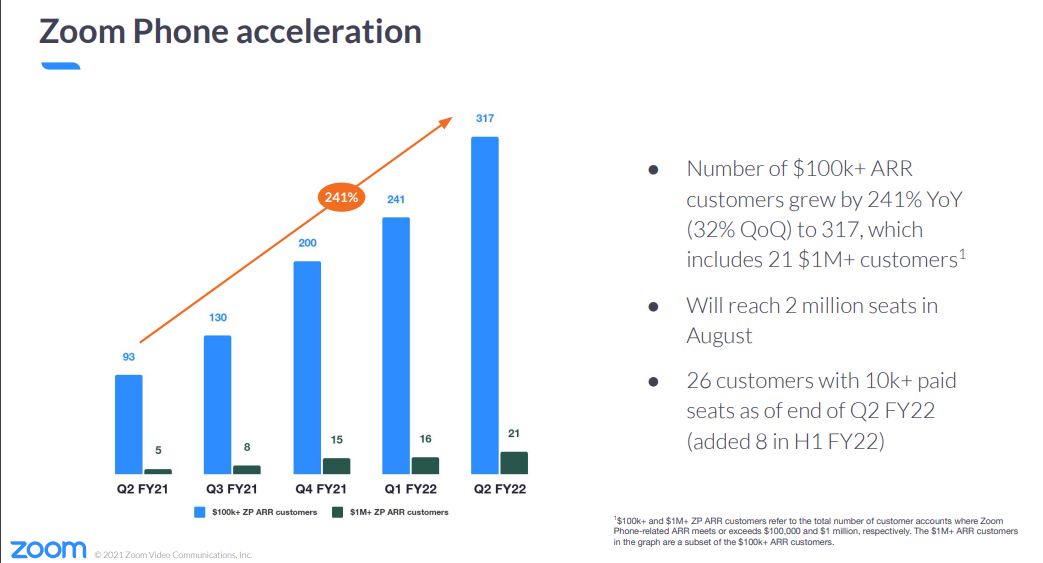

Zoom is clearly transitioning to be more of a platform play geared to large companies. CEO Eric Yuan said Zoom saw multiple upsell deals in the second quarter as companies add services like Zoom Phone and the company builds out its developer ecosystem. The acquisition of Five9 will also help the platform cause.

Rest assured that Zoom’s Zoomtopia conference and its analyst briefing on tap for September 13-14 will have a heavy dose of platform plans, strategy and news. Zoom is likely to leverage an industry-based go-to-market approach focusing on government, financial services, healthcare and education.

“Enterprises want digital platforms that combine meetings, phone, events, office technology, and developer solutions in a way that is simple, reliable, and frictionless. This fundamental truth underpins our leadership position in video conferencing and will help to drive further growth in Zoom Phone and Zoom Rooms, as we expand our platform and addressable market in the hybrid world,” said Yuan.

Indeed, Zoom Phone passed 2 million users. On the flip side, growth in customers with more than 10 employees is decelerating with churn picking up. Oppenheimer analyst Ittai Kidron said in a research note that “signs of normalization after a period of astronomical growth since the start of the COVID-19 pandemic are now showing.”

JMP Securities analyst Patrick Walravens noted:

Zoom sold prodigious amounts of its Meetings product to help people and businesses through the pandemic, but now the growth engine has to shift to platform services, Zoom Phone, and hopefully, contact center through the pending Five9 acquisition.

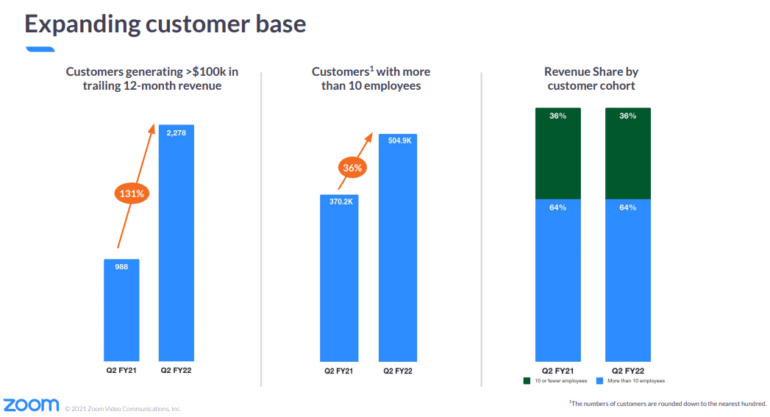

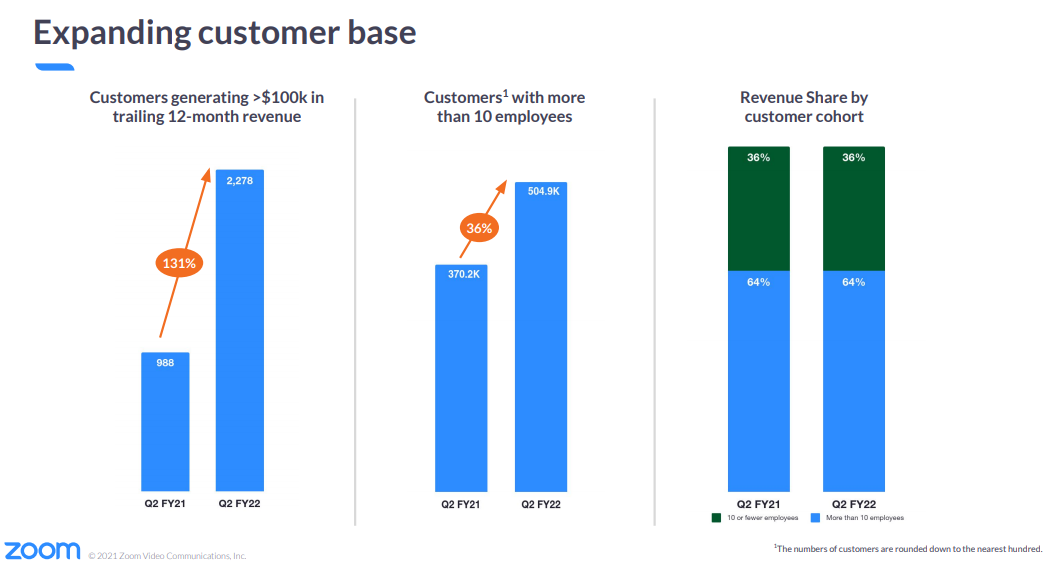

Kelly Steckelberg, CFO of Zoom, highlighted the Zoom Phone acceleration and platform plays. Zoom said it had 2,278 customers generating more than $100,000 in trailing 12 months revenue.

But Steckelberg also noted that online demand is a bit rocky. Zoom derives 40% of its revenue from monthly billings purchased online. “In Q2, customers with 10 or fewer employees represented approximately 36% of revenue, in line with Q2 last year, but down from its high of 38% in Q3 of last year. As we discussed previously, this cohort, which comprises SMBs and consumers who typically purchase online, is more volatile and we expect it to continue to decline as a percentage of revenue as customers adjust to the evolving environment,” said Steckelberg.

Steckelberg added that normalization of demand is going to be an ongoing theme.

It is important to note that as we’ve just lapped our first full quarter year-over-year compare since the start of the pandemic, we have seen customers return to more thoughtful, measured buying-patterns. While revenue, profitability, and cash flow were strong in the second quarter and the first half, other metrics have begun to normalize, especially when compared to the unprecedented year-over-year comps.

Bottom line: It’s not surprising Zoom shares are off 15% after a solid quarter. Wall Street is trying to handicap what normalization means for Zoom while weighing the promise of its platform and sales to large companies.