OnePlus 9 and OnePlus 9 Pro are strong devices hitting good price points, but to emerge as more than just a challenger brand and niche player it’s going to need more distribution and carrier support.

I’ve been testing both OnePlus phones and have enjoyed the clean Android without bloat, OnePlus’ UI, strong design and hardware, and a camera that’s now good enough if not quite on par with Apple iPhone and Samsung Galaxy 21 Ultra. Either phone can be a daily device. The OnePlus 9 packs a lot of value for the price.

As an AT&T customer, popping the SIM into OnePlus’ phones means I’m 4G and not 5G. The OnePlus Snapdragon 888 processor in the OnePlus 9 Pro should be able to work with all the 5G networks, but the issue is OnePlus’ devices aren’t certified for 5G on AT&T’s network.

OnePlus said it had no information to share on AT&T certification. An AT&T spokesperson said:

LTE (4G) is a mature technology enabling a wide variety of compatible devices for use on the AT&T network. 5G networks and devices, by comparison, are rapidly evolving. AT&T currently supports 5G on devices approved for use on our network to ensure the best customer experience. AT&T enables device manufactures to quickly gain approval for AT&T 5G, and we are actively evaluating expanding AT&T 5G support to more devices.

In other words, it’s unclear whether OnePlus devices will be certified for AT&T’s 5G networks in the near future. OnePlus devices get strong play on T-Mobile’s network and site. In fact, a recent visit to T-Mobile promoted OnePlus 9 and OnePlus 9 Pro along with the latest Samsung Galaxy and Apple iPhone devices.

Here’s a look at the OnePlus 9 pricing:

The OnePlus 9 phones also work on Verizon’s 5G network. Verizon Wireless features OnePlus a bit but not as much as T-Mobile does on its site. Regardless, OnePlus, which sells its devices unlocked, will garner more distribution than before with Verizon in the fold.

However, OnePlus needs AT&T to completely cover the US market in terms of distribution. Every year, OnePlus seems to be improving its devices and distribution.

The promise

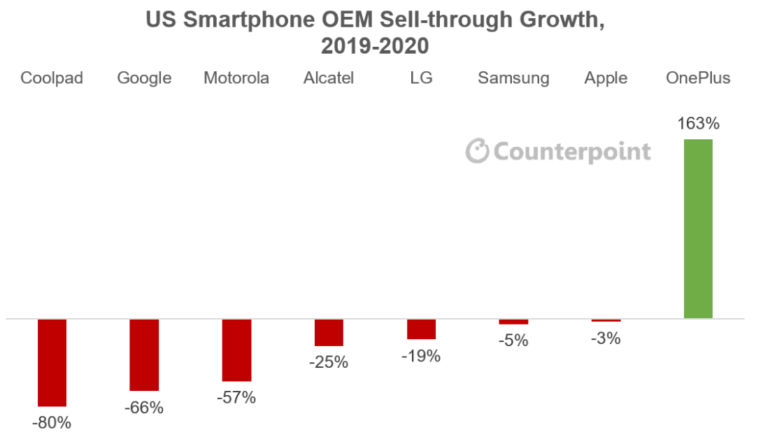

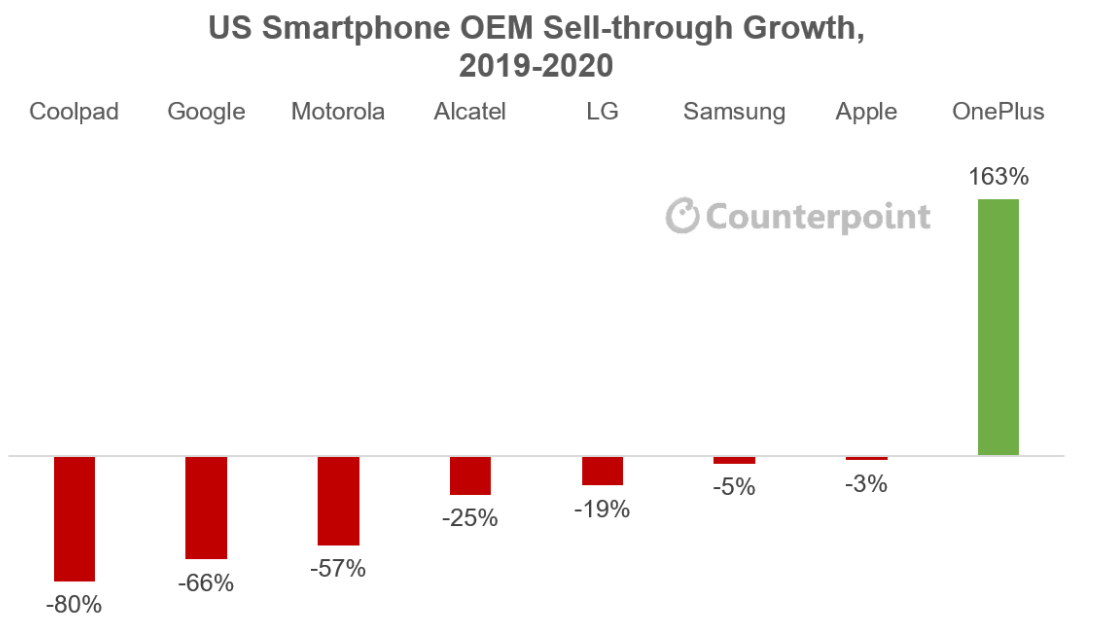

The midmarket 5G smartphone sector is crowded and cutthroat. US consumers have a lot of options, but OnePlus in 2020 showed the most growth in the smartphone sector.

According to Counterpoint Research, OnePlus showed good sales traction largely due to T-Mobile. The research firm said:

OnePlus continued to be a challenger brand in 2020 as it was able to grow its channel presence and overall size from a small base 163% YoY. While Apple and Samsung did post YoY gains in Q4 2020, their overall market sell-through was down for 2020. Other OEMs such as Motorola, LG and Google either faced supply issues or saw demand for their devices decline. The demand decrease was more strongly seen in the prepaid market.

OnePlus showed strong growth, especially in carrier channels. It has long had a relationship with T-Mobile, starting with the OnePlus 6T in late 2018, and has continued launching new devices in Sprint starting 2019.

Verizon has the OnePlus 8 UW and now supports OnePlus 9 and OnePlus 9 Pro.

Counterpoint Research reckons that OnePlus was able to grow by appealing to “consumers who became disenfranchised with current premium smartphone offerings.” Part of that disenfranchisement is price, but a lot of it is that folks want something other than Apple and Samsung. Motorola, HMD’s Nokia, and OnePlus are some of the companies trying to be more than “other” in the market share stats.

With LG leaving the smartphone market, there is roughly 10% of the market up for grabs. Samsung is obviously looking to take that share with compelling devices at multiple price points.

We caught up with Counterpoint analyst Maurice Klaehne to gauge OnePlus’ prospects. Here’s what he had to say:

Does OnePlus need AT&T if it already has T-Mobile and Verizon? “AT&T has historically been very iPhone dominated, with Samsung being the top Android OEM. It’s the most entrenched postpaid channel in this regard which makes it difficult for OnePlus to enter the channel and capture share,” said Klaehne. “Other postpaid channels have a more diverse base and offer more SKUs. Prepaid may be a better option for expansion for OnePlus.”

What boosted 2020 sell-through for OnePlus? “OnePlus has grown over the years, from being unlocked only, to gaining entry into T-Mobile, Sprint, Verizon, and now Metro by T-Mobile. The OEM started with a small base, so their entry into Verizon in 2020 helped them grow their overall sell-through as their devices were sold in more channels,” he said.

What sweet spot of the smartphone market should OnePlus go for? “The US market has remained premium driven, with much of the $400 to $700 market being either too expensive for the prepaid market, or not high spec’d enough for the postpaid market. There have been some standouts from Google and Samsung A-series due to the focus on cameras, but overall, the demand for this midmarket range has not grown much,” said Klaehne. “Some of the best-selling devices from Apple and Samsung in the past have all been priced around $750-$800 which comes out to a monthly payment plan of $31.25-$33.33. This monthly payment rate has been the sweet spot for most postpaid consumers.”

ZDNET’S MONDAY MORNING OPENER

The Monday Morning Opener is our opening salvo for the week in tech. Since we run a global site, this editorial publishes on Monday at 8:00am AEST in Sydney, Australia, which is 6:00pm Eastern Time on Sunday in the US. It is written by a member of ZDNet’s global editorial board, which is comprised of our lead editors across Asia, Australia, Europe, and North America.